Level 1

Asset

An asset is simply something you own that has value.

This can simply be the money you have in the bank, your primary residence if you have finished paying it off; your investments such as stocks or real estate; but also other assets like a car or jewelry.

Liability

A liability is a sum of money you owe because it doesn't belong to you. For example, a mortgage, a consumer loan, or unpaid bills.

While it's important to manage liabilities carefully, they can be very useful for accumulating wealth more quickly (see leverage)

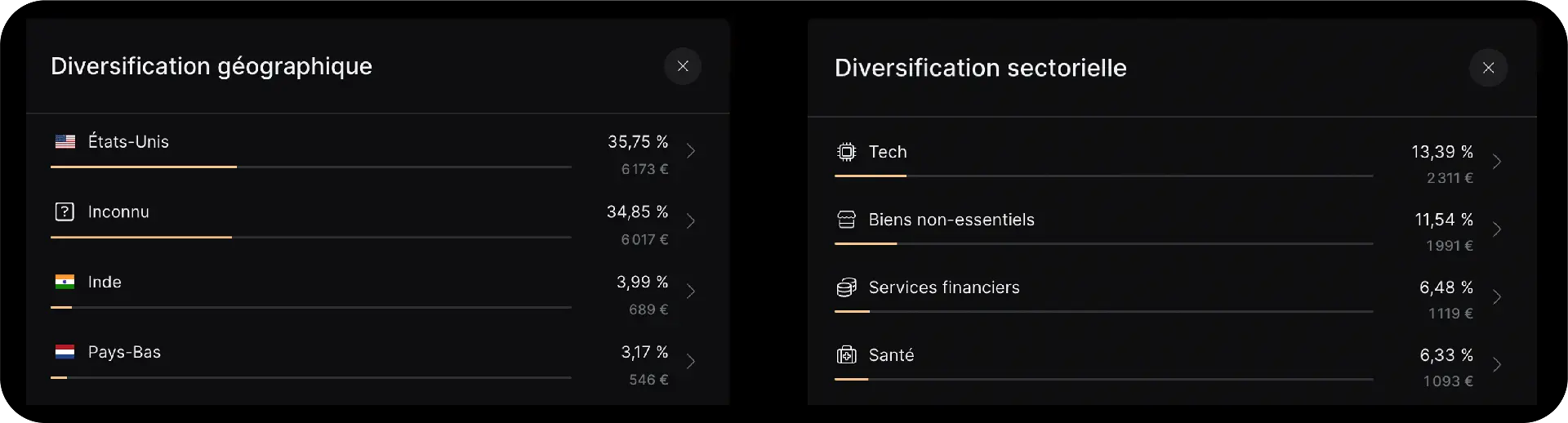

Diversification

"Don't put all your eggs in one basket."

Imagine if your bank fails; it's a big problem if it was your only bank. However, it's less dramatic if your money was distributed among two other banks.

If real estate loses 50% of its value due to a new law, it’s serious if you have bet everything on property. It’s acceptable if you have, for example, 40% in real estate, 30% in stocks, 10% in Private Equity, 10% gold and 10% Bitcoin.

Diversifying your investments means spreading your money across different types of assets, intermediaries, industries, currencies, and countries to reduce risks.

Liquidity

Liquidity is the ease and speed with which you can convert your assets into cash without losing value.

For example, the money in your checking account is very liquid – you can use it immediately. Stocks are generally liquid too, as you can quickly sell them on the market. However, selling a house can take time, making it less liquid.

Return

The return is what you earn on your investments. This can be the interest received from a savings account.e, dividends or the rents of a property.

Return is often expressed as a percentage to give you an idea of how much your investment earns each year relative to its cost.

Risk Tolerance

Risk tolerance is simply knowing the risks you are willing to take to potentially earn more. It's very personal.

If you've ever gambled, you probably have some idea of your risk tolerance. Are you the type to bet everything on red, or do you try to increase your gains gradually?

This greatly influences how you should invest. For example, safe investments like bonds are better suited for a low risk tolerance because the volatility is lower, while stocks or cryptocurrencies are suitable for those who are willing to take on more risk in hopes of greater gains.

Investing shouldn't keep you up at night. If you check your stocks' performance multiple times a day out of fear of losing, then you should reconsider your strategy.

Level 2

Volatility

The volatility of an asset, such as a share, is its ability to fluctuate sharply up and down. For example, technology companies such as Apple or Microsoft are said to be highly volatile, as their share prices often resemble roller-coaster rides. The slightest news can cause the price of a share in the company to change dramatically.

The greater the volatility, the greater the risk of losses and potential gains.

Here are two examples of very different actions.

Emergency Savings

An emergency savings fund is your financial safety net. It’s the money you keep in an accessible account (like a savings account) to cover unexpected expenses. The idea is to avoid having to borrow or sell investments in an emergency. It's generally recommended to have the equivalent of three to six months' expenses in this reserve. The rest can be invested.

Asset Allocation

Asset allocation is like deciding the proportion of your meals between proteins, vegetables, and carbohydrates. In the financial world, it means spreading your money across different types of investments (stocks, bonds, real estate, etc.) according to your liquidity needs, risk tolerance, and especially your life goals. In other words, it’s your strategy.

Due Diligence

Due Diligence refers to the verifications you must conduct before investing. Whether it's on a platform to buy stocks, a real estate transaction, or investing in private equity in a company, you need to assess potential risks and uncover what might be hidden from you.

My Due Diligence by Type of Investment

Stock Market:

- Understanding what I am investing in (stocks, ETF, bonds, etc.)

- Understand and choose the most optimized envelope (PEA, AV, CTO)

- Check the Liquidity: of the fund, ETF, stock, etc.

- Verify All Associated Fees: with the investment

- Check the Company's Current Affairs.

Cryptocurrency:

- Understand the Project.

- Choose a Registered Platform: PSAN and based in a developed country for investment.

- Focus Primarily on BTC and ETH: (already very volatile)

- Avoid Trends: (NFTs, Play-to-earn, Memecoins, etc.)

Private Equity:

- Understand the Company's Business Model.

- Evaluate the Long-term Potential: of the project.

- Check the Founders' and Teams' Experience.

- Assess the Visible Quality of the Team's Work: (application, website, marketing, communication, etc.)

- Check the Company's Current Affairs.

- Compare the Company with Its Competitors.

- Invest Through a Platform Approved by an Institution: such as the Prudential Supervision and Resolution Authority (ACPR).

- Understand the Project Being Funded.

- Select Short Investment Durations: (< 3 years)

- Check the Repayment Rank: (Junior or Senior)

- Assess the Project's Company's Location and Stability.

- Investing through a platform approved by an institution such as theAutorité des Marchés Financiers (AMF)

Note that these verifications are my personal guidelines. They do not cover all aspects necessary for an investment decision and do not replace your own thorough research.

Basis Points

It's simply another way to express percentages.

- 1 basis point = 0.01%

- 100 basis points = 1%

This term is often used to describe changes in a percentage. For example, if an interest rate goes from 2.00% to 2.25%, it is said that there has been an increase of 25 basis points.

Unit-Linked Investments (UC)

If you have ever opened a life insurance policy, you must have encountered this term. You were asked to choose the allocation between euro funds and unit-linked investments in your contract.

The euro fund is the secure part that yields a low return, while unit-linked investments are riskier but have better potential returns.

There are three types of unit-linked investments:

- Securities: bonds, stocks, ETFs, SICAV (Investment Company with Variable Capital), Mutual Fund (FCP).

- Real estate values: SCPI (Real Estate Investment Company), SCI (Civil Real Estate Company), OPCI (Collective Real Estate Investment Organization).

- Monetary Values : Money market funds, Government bonds, Certificates of deposit.

Level 3

Welcome to the heart of the global finance world, the Stock Market.

Stocks

Imagine if you were the owner of Apple?

Well, that's exactly what happens when you buy an Apple share at €150.

The stock market is precisely the place where company shares are bought and sold.

For publicly traded companies, there are thousands of owners like you called shareholders. All those who hold a part of the company receive a portion of the company's profits (dividends). They are also invited to vote at general meetings to make decisions.

The more people want to own Apple, the higher the price of a share goes. Conversely, those who no longer believe in the company sell their share, and the price drops if there are more sellers than buyers.

So, Tim Cook is not the owner of Apple? No.

He is the CEO. That is to say, he is the employee chosen to lead the company. Like you, he receives a salary at the end of the month to fulfill this role and can be fired if the results do not meet expectations.

But between us, I think he has Apple shares (and even a lot), which also makes him a part-owner of the company.

Dividends

Dividends are the money you receive simply because you own shares in a company. By buying a share, you become a part-owner of a company. If the company makes a profit that year, it must decide how much to keep to fund its projects and how much to give to its owners.

If a company does not pay dividends, it chooses to reinvest everything to continue growing.

Take the example of McDonald's. If you own a share of the company, you will receive an annual dividend. Currently, it is 2.57% of the share price, which is $6.68 per share, but this amount can change based on the company's future decisions, stock price fluctuations, and the growth or decline of the dividend.

Bonds

A bond is like lending your money to a company or a government, and in return, they promise to repay you with interest on specific dates in the future. This is what you buy when you invest your money in a euro fund. Bonds are considered less risky than stocks but generally offer lower returns.

Coupons

The coupon is somewhat equivalent to a stock's dividend but for a bond. It is the interest paid to you for the money you lent. You know in advance when they will be received.

Stock Market Index

A stock market index is a measure that shows how a group of stocks is performing. For example, in France, to know how our companies are doing, we created the CAC40. Basically, it groups the 40 largest French companies listed on the stock exchange to measure their average performance.

Imagine the Paris Stock Exchange as a high school where each student represents a large French company listed on the stock exchange. The CAC 40 is like a selection of the 40 best students in this high school.

Every day, we take the grades of these 40 students and average them. This way, we see if they are better than the day before.

But why not directly average all the students? Simply because, unlike students, the largest companies do not have the same impact as the smaller ones. If L'Oréal or TotalEnergies collapses tomorrow, the impact on the French economy will be very significant.

ETF (Exchange-Traded Fund)

You just had a genius idea. Instead of randomly buying a few shares, you want to buy them all to limit the risk. Well, that's exactly what ETFs are for.

An ETF, or Exchange-Traded Fund, is simply a way to buy in bulk.

There are thousands of all kinds that allow you to replicate the performance of stock indices (CAC 40, Nasdaq, S&P 500, etc.), countries, a sector of activity, etc.

Do you have a conviction about India but don't know their companies? Then you can buy all the largest Indian companies at once through the iShares MSCI India ETF.

Stock Picking

Stock picking could be considered the opposite of an ETF. Instead of buying the entire market, you select and purchase individual stocks.

If you hold any stock outside of an ETF, it's stock picking.

This doesn't mean you can't be well diversified; it's just more complicated.

Level 4

While Level 3 helped understand the basics of the stock market, now we will differentiate the four ways to invest in it. The differences lie in what you can buy and the taxes you'll pay in case of gains.

CTO (Regular Securities Account)

The simplest, hassle-free option. This is the type of account opened for you when you download any application that allows you to buy stocks (personally, I use DEGIRO and Trading 212). You can buy almost anything with a Compte Titres Ordinaire. If you make money from selling, your profits will be taxed at 30% of the capital gain you made. It may seem like a lot, but at least you've earned.

Why do I have 2?

For the most well-known stocks, I use Trading 212 because it's commission-free. It's the simplest to use and really simplified for beginners. I use DEGIRO additionally for very specific stocks that I can't find on Trading 212.

PEA (Stock Savings Plan)

What hurts with the CTO is the 30% on capital gains. So France offers a deal: you invest in French or European stocks, and in exchange, you only pay 17.20% in taxes on your profits.

The only condition is that it must be open for more than 5 years.

One of the first things to do if you plan to start investing is to open your PEA and a Life Insurance policy. Even if you're not sure about investing or don't have money to put in right now, do it. At least the 5-year countdown will have started, and you'll be very happy the day you decide to invest.

Life-Insurance

This has nothing to do with the insurance you may know. While a sum of money is paid to your heirs in case of death thanks to your life insurance, it is primarily a means of investing.

Like the PEA, it offers lower taxes on capital gains when held for more than 8 years.

Another very interesting feature is that you can include much more than just stocks. Particularly, real estate in REITs.

Same advice as for the PEA, even if you're not ready to invest, open it anyway to start the fiscal advantage countdown. At least, when you need it, you can enjoy your profits more quickly.

Criteria | CTO | PEA | Life-Insurance |

Opening Conditions | No specific age or residency conditions. | Minimum age of 18. French tax residency. | No specific age conditions. Open to residents and, under conditions, non-residents. |

Maximum Quantity | Unlimited | 1 per person. 2 per tax household maximum. | Unlimited |

Contribution Limit | No contribution limit. | PEA : 150 000 €. (cumulative with PEA-PME for a total of €225,000 per person). | No limit but capital guaranteed up to €70,000 in case of insurer's bankruptcy. |

Available Assets | Stocks, bonds, funds, etc. International without market restrictions. | Stocks of European companies, certain eligible funds (SICAV, FCP). | Wide range including euro funds, unit-linked (stocks, bonds, REITs, etc.). |

Taxation and Conditions | Income tax or flat tax of 30% (including social contributions). | Exemption of capital gains after 5 years of holding, excluding social contributions (17.2%). | Advantageous taxation on capital gains after 8 years, particularly with an allowance. |

PER (Retirement Savings Plan)

The PER allows you to gradually prepare for retirement (the earlier, the better). Money invested in this plan can be unlocked when you reach retirement, with exceptions like purchasing a primary residence or in case of life accidents.

Presented like this, it may not seem very advantageous, but the secret lies in the fact that contributions are deductible from taxable income up to 10% of your past year's income or 10% of the annual social security ceiling.

Level 5

Diving into the heart of real estate.

Full Ownership

Full ownership means owning a property entirely, with all the rights attached to it. This means you can use it as you wish, rent it out, sell it, or even pass it on. For example, if you fully own your house, you have the right to do whatever you want with it, as long as it is legal.

Bare Ownership

Bare ownership means owning a property but not being able to directly benefit from it. Imagine you have a house, but someone else (the usufructuary) has the right to use it and receive the income from it (like rent). You are the owner, but you will have to wait until the usufruct ends to regain full enjoyment of the property. Bare ownership is often used for estate planning, allowing you to prepare for succession in an optimized manner.

Tip 1: Buying in bare ownership is useful for increasing your assets without increasing your income, thus avoiding moving into a higher tax bracket.

Tip 2: You can even buy shares of REITs (SCPI) in bare ownership. It's a good way to accumulate more shares if you don't need additional income right away.

Usufruct

Usufruct is the right to use a property and receive its income without owning it. For example, in the case of an apartment, the usufructuary can live in it or rent it out and collect the rent, but cannot sell it. This usufruct right is often temporary, for example, until the end of the usufructuary's life or for a determined period. Once this right expires, the bare owner regains full ownership of the property.

Example of a Bare Ownership and Usufruct Transaction:

Mr. Niel, aged 70, owns an apartment in Paris that he wishes to pass on to his daughter Sophie Niel while continuing to live there. To do this, he decides to make a donation with property division.

Bare Ownership: Mr. Niel gives the bare ownership of the apartment to his daughter Sophie. This means she becomes the owner of the property but cannot use it or receive its income for now.

Usufruct: Mr. Niel retains the usufruct of the apartment. This allows him to continue living there or to rent it out and collect the rent until his death.

Thus, Sophie becomes the bare owner of the apartment and will become the full owner (full ownership) at the end of the usufruct, i.e., upon her father's death. In the meantime, Mr. Niel retains the use and benefits of the property without being the full owner.

SCPI (Real Estate Investment Trust)

An SCPI is a company whose activity is to buy real estate, manage it, or sell it. SCPIs are not listed on the stock exchange, but you can buy shares in these companies. You are thus the owner of a part of the company's properties and receive rental income. The share price evolves according to the value of all the company's real estate. This is known as "paper real estate."

Why invest in SCPI rather than in physical real estate?

You don't have to choose between one or the other; you can do both.

The main advantage of SCPI is its passive investment nature. Unlike direct rental investment, you don't need to manage the properties yourself. The management company takes care of everything: acquiring offices, shops, or apartments, managing tenants, and redistributing the collected rents to investors.

By choosing a good SCPI, you significantly reduce the risk of errors. Instead of concentrating your investment on a single property, you acquire a share of a company that owns a diversified portfolio of hundreds, even thousands of properties, often in different countries. This diversification helps avoid impactful problems such as unpaid rent, vacancy, or simply buying a property with significant issues. Not to mention that you are entrusting your money to experts whose job it is.

SCPIs also offer access to rare and professional real estate, often inaccessible to an individual investor. This includes offices, shopping centers, healthcare facilities, etc.

Finally, investing in SCPI is more financially accessible. The entry price to buy shares can start from a few tens of euros, for example, in life insurance.

Tip 1: Like physical real estate, you can borrow from your bank to leverage your investment.

Tip 2: You can invest in certain SCPIs through your life insurance to reduce taxation.

REIT (Real Estate Investment Trust)

REITs are the publicly traded version of SCPIs. Investing in a REIT is like investing in a variety of real estate properties (offices, shopping centers, residential units, hotels, etc.) spread across different geographic regions, which reduces the risk compared to buying a single property. Since they are listed on stock exchanges, REIT shares can be bought and sold easily, providing liquidity that direct real estate or SCPIs lack. REITs must distribute at least 90% of their taxable income as dividends to their shareholders, which can provide a regular and attractive income stream.

REITs are very popular in the United States, but can be found all over the world. They are also known as “foncières cotées”.

SIIC (Real Estate Investment Trust)

SIICs are the French version of REITs. These companies are listed on the stock exchange and invest primarily in real estate. Like REITs, they must distribute a large proportion of their income in the form of dividends to their shareholders. Like REITs, they are also known as foncières cotées.

Level 6

Welcome to the land of funds.

Investment Funds

A generic term that includes various types of funds, including mutual funds, open-ended investment companies (SICAV), index funds (ETF), pension funds, etc.

OPCVM (Collective Investment Scheme in Securities)

An OPCVM is like deciding to invest in company shares with a group of friends. You bring together, in a single portfolio, what each of you is prepared to invest. You entrust this portfolio to a group of investment experts who will invest for you and try to grow this capital. This group of experts is the UCITS.

Rest assured, you don't need to find ten friends to invest in an OPCVM with you. The organization already has a portfolio open to anyone who wants to come and invest.

There are two main types of OPCVM :

- SICAV (Société d'Investissement à Capital Variable) : A company that issues shares.

- FCP (Fonds Commun de Placement) : A fund that issues shares.

Mutual Fund (FCP)

A mutual fund is a way to delegate the management of your investments. Instead of buying stocks or bonds yourself, you entrust your money to experts who decide where and how to invest it. The money from all investors is pooled together to be managed collectively, which is why it's called a mutual fund.

The fees are often quite high, but some have achieved excellent performance for many years.

SICAV (Variable Capital Investment Company)

At first glance, a SICAV seems quite similar to a mutual fund. The main difference is that when you invest in a SICAV, you become a shareholder of the company. You don't just hold a share of the assets. This means you can participate in the life of the company you own, including attending general meetings and voting on company decisions.

Fund of Funds

A fund of funds is a type of investment fund that does not invest directly in stocks, bonds, or other assets but rather invests in other investment funds.

The idea is to further diversify investments by spreading assets across multiple funds, each with its own strategies and objectives. This allows investors to benefit from the professional management of several funds while reducing the risks associated with a single investment. In summary, a fund of funds is a "super fund" that groups several other funds for optimized diversification and management.

Level 7

Time to talk strategy.

Compound interest

Let's take a concrete example. You deposit €5,000 in your Livret A savings account, which earns 3% interest a year. At the beginning of next year, you will have earned €150 from this investment, so there will be €5,150 in your Livret A.

The following year, if you haven't touched anything, instead of earning money on €5,000, your passbook will earn 3% on €5,150. That's €154.5, or €4.5 more than the previous year.

In other words, last year's interest generated new interest.

For the time being, an extra €4.5 won't make much difference to you. That's normal, because the power of compound interest grows over time.

In 30 years, without adding 1 cent, you'll have €12,136 without doing anything with this strategy.

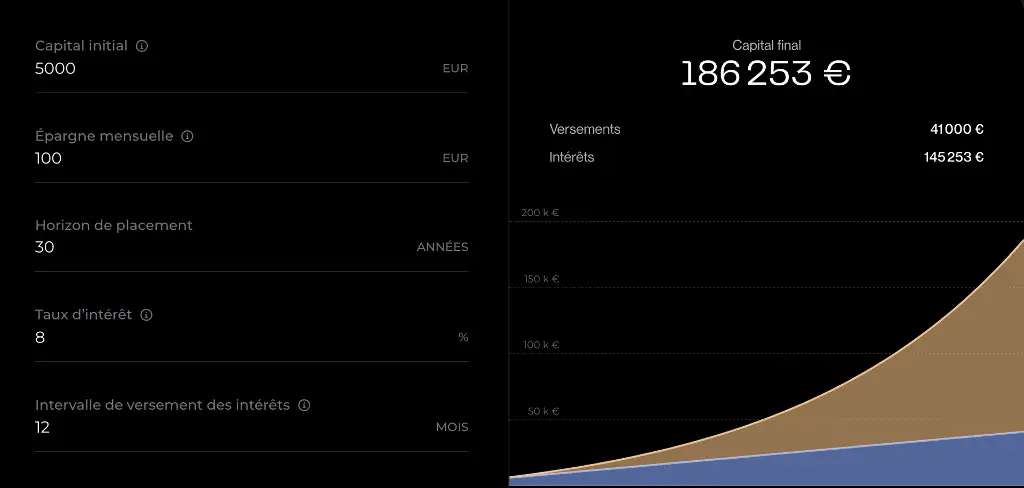

Let's imagine the same thing with a more ambitious strategy. On top of the basic €5,000, we add €100 per month. Instead of investing this money in a Livret A passbook, we invest it in the stock market, with a fictitious return of 8% a year for the same 30 years.

This will give a capital of €186,253 for €41,000 invested and €145,253 generated solely by reinvesting interest.

These simulations were carried out using a tool proposed by Finary.

DCA (Dollar-Cost Averaging)

Dollar-Cost Averaging is the practice of investing the same amount of money in a particular asset at regular intervals (monthly, weekly, yearly, etc.). This helps to average out your entry price and eliminates the worry of buying too high or too low. You are betting on the long-term growth of the asset.

Lump Sum

Lump Sum is somewhat the opposite of DCA. Instead of spreading your entry points over time, you invest all you want to invest at once. It may seem risky, but in the long term, it is a proven method.

Leverage

Leverage means borrowing money to invest more. This is mainly possible for investments in real estate (physical or SCPI).

Indeed, during your real estate acquisitions, you can seize this opportunity. Try to borrow as much as possible while limiting your down payment to reserve your money for other investments.

FIRE (Financial Independence, Retire Early)

This acronym stands for "Financial Independence, Retire Early." It's a movement where followers aim to become financially independent as quickly as possible. To achieve this, they limit their spending to the most essential needs for several years to save and invest as much as possible. This allows them to live off passive income and stop working.

The FIRE movement includes several subcategories that differ mainly in the level of frugality and financial goals of each individual.

Lean FIRE

This sub-category is the most extreme version of this movement. In concrete terms, it's all about achieving a minimum passive income that covers all the most vital needs, and stopping working. They are not big spenders, and prefer freedom.

Fat FIRE

Opposite to Lean FIRE, Fat FIRE targets a higher standard of living. They wait until they have significant income before retiring.

Barista FIRE

Barista FIRE forms another branch of the movement where individuals achieve semi-financial independence and continue to work part-time, often in less stressful or more enjoyable jobs.

Coast FIRE

Coast FIRE is the fourth and final form of the movement. Here, followers seek to invest as much money as possible early in their careers. Rather than spreading their investments over time (DCA), they prefer to make the largest investment possible early to benefit from the snowball effect of increasingly significant compound interest as the years go by.

Summary:

Subcategory | Frugality level | Financial Goal | Example Annual Income |

Lean Fire | High | Minimal budget | 20 000 € |

Fat Fire | Moderate to low | Comfort/Luxury | 80 000 € or more |

Barista Fire | Moderate | Semi-independence | Variable (part-time) |

Coast Fire | Variable | Passive growth | Variable (current) |

Level 8

Let's take a look at some lesser-known investments.

Crowdfunding

Crowdfunding, allows a company to raise funds from individuals to finance a project without using its personal treasury. This can be compared to when you make a down payment to buy a house.

To avoid using its personal funds, a company turns to individuals to gather the necessary funds to constitute this down payment.

On platforms like Enerfip, for example, you can invest in renewable energy projects with an annual return of 5 to 10%.

If you prefer real estate, Homunity offers the opportunity to finance the down payment for renovation, construction, or purchase/resale of real estate projects.

Futures Contract

A futures contract is an agreement between two parties to buy or sell something at a future date but at a price fixed today. It's like reserving one ton of wheat at today's price but receiving it in a year. Farmers and investors use these contracts to protect against unpredictable price changes, such as those caused by the war in Ukraine.

Structured Product

Structured products are custom-made investments combining several financial tools (stocks, stock indices, bonds, etc.). Generally, they serve to invest while protecting a large part of the invested capital. This necessarily impacts potential gains. Beware of the high fees that are often applied.

These products are interesting to understand because there's a good chance your banker will try to sell them to you one day. As a large part of your investment is often protected in case of a downturn, it becomes a good argument for less knowledgeable investors.

I have not invested in this type of asset even though it is part of recent trends. Therefore, I do not have a strong opinion on it.

Private Equity

Remember the definition of stocks? Well, private equity is the equivalent for investing in non-publicly traded companies like start-ups. It's a trend in recent years, a very risky bet given the fragility of this category of companies, but with a very significant growth potential.

Level 9

You'll soon be able to have a serious discussion with any wealth manager.

ISIN (International Securities Identification Numbers)

The ISIN is like the barcode of your investments. Each stock, bond, or financial security has a unique 12-character number that allows it to be precisely identified worldwide.

For example, if you want to buy shares of LVMH, you will use its ISIN code (FR0000121014) to ensure you are buying exactly what you want. Type this number into Google and you'll see.

Lombard credit

Lombard credit allows you to borrow money against your financial assets, similar to mortgaging a house. If you don't repay the money the bank lent you, the bank seizes your house to get repaid. It’s the same with Lombard credit, but with your stocks, bonds, and other financial securities.