Satisfaction:

Potential Return:

Associated Risk: High.

Investment Horizon: 1 to 5 years.

Summary

Finally, an easy and affordable way to invest in shares of alternative assets such as luxury watches, prestigious wines and spirits, and collectible cars. I've been familiarizing myself with the platform for a few months now, and it’s time to offer a thorough analysis of this Irish player in alternative investments.

Highlights of Konvi

- A wide range of categories for good diversification

- High-quality and specialized partners

- Extremely affordable minimum investment of €250 per offer

- Very significant past returns

Weaknesses of Konvi

- Founders with no past entrepreneurial experience or financial background

- Lack of transparency on fees

- A technical team that is slow to respond to complex requests.

Context

Although I appreciate the world of finance, I have always had a preference for tangible assets. I am neither a collector nor a specialist, but I appreciate beautiful things like the precision of a high-end watchmaker's mechanism or the history behind a Louis d'Or coin. The only categories that don't evoke any emotions in me are art and wine. I'm not drawn to art because I don't understand it, and I'm not attracted to fine wines because I don't generally like the taste of alcohol.

I think it's an asset not to be passionate or emotionally impacted by the investments one makes. Acting on emotions rather than factual information is a common pitfall for beginner investors, regardless of the investment category.

It was only natural that I sought to invest in what are called exotic assets or alternative investments. After exploring all the traditional financial investments (stocks, ETFs, bonds, REITs) and diversifying with crowdfunding, private equity, and even cryptocurrencies, I decided it was time to indulge and allocate a small portion of my capital to these tangible investments.

What is Konvi?

Founded in 2020 by Eran Peer (current CEO) and Ioana Surdu-Bob (current COO), Konvi aims to be the first platform dedicated to co-investing in collectible items. Here, you will find offers to invest in wines and spirits like limited editions of whiskey, Burgundy wines, or rare champagnes. You can also acquire shares in artworks from all eras, vintage cars, and luxury watches. Even rarer, several sales of Hermès Birkin bags, dinosaur fossils, and precious stones have already taken place.

Konvi stands out with its very low entry fee of just €250, enabling individuals to become owners of tangible assets. This gives small investors the opportunity to replicate the strategies of the wealthiest, who until now have been the only ones benefiting from the significant appreciation of these asset classes over time. According to our information, Konvi raised $900,000 in 2022 from well-known investment funds such as Alex Springer (Germany's leading media group) and Porsche.

How does Konvi work?

Konvi works in close collaboration with a network of specialized partners who are responsible for finding, buying, and selling the collectible items offered on the site. When a partner identifies a potential good deal, they invite the Konvi community to participate in the purchase of that item. This is called an Initial Asset Offering (IAO) or Offre Initiale d'Actif (OAI) in French.

If the amount is raised on time, then the asset is purchased by the partner and you become a co-owner of the item through the status of Collective Investor Group (CIG). If the minimum amount to be raised is not reached, everyone is refunded.

An intermediary trust company is tasked with certifying that you are indeed the owner of the asset in case of Konvi’s bankruptcy. While waiting to find a buyer, the asset is stored and insured by the partner.

Each of these partners has a specific area of expertise, including:

- Cask Trade, Cult Wines, and Oeno for fine wines and whiskey

- The Watch Fund for luxury watches

- TheCarCrowd for vintage vehicles

- Vorona Galerie, TGB Contemporary, Marat Gelman & Co., and Art Most for artworks

- Love Luxury for Hermès Birkin bags

- Fossil Realm for dinosaur skeletons

- Ruby International for precious stones

The interest for these partners is to have more resources to acquire more assets or rarer pieces, ultimately contributing to their growth.

The Process of an Investment

- Initial Asset Offering (IAO) Published

The offer is made public with all the associated information. This includes the name of the partner, their performance history and characteristics, the asset class, the expected appreciation period, the ideal amount to be raised, and the pre-Key Information Document (pre-KID) with the fees and risks associated with the operation.

Note that the exact item is not known in advance; only the category gives you an idea of what will be sought with the collected funds.

- Pre-orders

Before being able to invest, Konvi reserves a period for interest in the offer to be expressed through pre-orders, thereby guaranteeing priority access to those interested.

- Opening of Fundraising

Once the IAO is officially launched, users can formalize their co-ownership via bank transfer or credit card.

- Finalization and Purchase of the Asset

If the minimum fundraising threshold is reached, all users must provide proof of identity and sign a purchase contract.

The specialized partner identifies and selects a collectible asset with the highest appreciation potential, with a purchase price close to the collected investment amount.

Konvi then acquires the asset, and all users become the legal owners of the collectible asset.

- Publication of the Asset

Specific details of the asset such as photos, purchase price, and all other available specifications are provided to investors and made public.

- Appreciation Period and Sale.

At the end of the appreciation period, if the partner has not yet sold the asset, they have 6 months to find a buyer.

All net profits are then redistributed to the owners.

The setup used

Unlike Caption, Konvi does not seem to rely on a holding company to gather all investors and financialize the underlying asset. However, it states that it uses an intermediary trust organization to manage your ownership title while waiting for the sale. This would protect you in case of any issues with Konvi or its partner. For the various operations I have conducted, Classic Valuable Assets CLG was this intermediary. It is also a regulated entity in Ireland.

Fundamental Analysis of Konvi

This is a necessary step to mitigate the risks associated with your alternative investments. Fundamental analysis is here to highlight potential risks that you might encounter during your operation.

Is Konvi Legal?

On this point, it is noted that the company is regulated by the Central Bank of Ireland. This is a good sign, given that it is the reference authority on financial market regulation in Ireland, equivalent to the Autorité des Marchés Financiers (AMF) in France.

However, Konvi does not adhere to the investor compensation scheme implemented by The Investor Compensation Company DAC (ICCL), which offers financial protection to clients of regulated Irish investment companies in case of their failure.

Another black mark, Konvi specifies in its footer that it is "neither an investment platform, nor a financial broker, nor a financial advisor." Strange for a site whose FAQ contains the word "investment" 25 times. I believe this is because Konvi defines itself as a platform that acts as an intermediary between individual investors and its partners. This is probably an obscure legal formality.

Profiles of Konvi’s Founders

- Eran Peer:

In 2018, after successfully completing his higher education with honors from Cardiff University, he moved to Berlin for 4 years to hone his skills as a software engineer. He notably worked as Chief Engineer at Medwing (a Medtech with $46.5 million raised in series C). He then founded Konvi in May 2020 and a venture capital fund (EIP Ventures) two years later with the same partner. This fund claims to operate in over 30 countries and to have invested in more than 20 companies in 2 years, including Konvi.

- Ioana Surdu-Bob:

It was at this same university in Cardiff that Ioana met Eran. She followed him to Berlin, where she spent nearly two years working at Blacklane as a backend engineer. She then gained over a year of experience at both Shopify and Techstars before embarking on the Konvi venture with Eran.

- Lena Sonnen:

Although she left the venture after two years of involvement, Lena was one of the key founding members of the project. Drawing from her experiences at major companies such as EY, HUGO BOSS, and BMW, she joined Meta as an Account Strategist. During her two years at Meta, then still known as Facebook, she supported startups in their growth strategies, earning two promotions in recognition of her impact and commitment.

My Analysis: We don't know much about this mysterious duo, but for now, everything seems to be working for them. It appears that we are dealing with two very similar profiles with interesting technical skills but a severe lack of entrepreneurial experience. Nevertheless, they are sending positive signals with the creation of their venture capital fund and the acquisition of their French competitors, Diversified and Fractible.

Is Konvi Reliable?

If we include the operations carried out by Diversified.fi, which was acquired by Konvi, it can be said that the company has already successfully financed more than 100 tangible and original asset operations and earned the trust of thousands of investors who have been able to invest in watches, artworks, bottles of wine, collectible cars, fossils, and even Birkin bags. The initial feedback from investors seen on Trustpilot, forums, and blogs is generally positive, but few reports mention operations closed through the sale of the underlying asset.

The partners, a central element of the activity, are for some large structures with hundreds of employees and a strong reputation in their field. Others are smaller but have been in place for many years. Another reassuring point is that the headquarters of these associated companies are mostly located in highly regulated countries and major cities like London or Toronto.

Alternatives to Konvi

When it comes to exotic assets, France is in the spotlight. Here are three French companies that offer or have offered similar services to Konvi.

Caption

Initially, Caption is a platform that acts as an intermediary between shareholders of unlisted startups and investors looking to enter the capital of these French Tech companies. Recently, the company has diversified and now offers many opportunities to invest in exotic or even ultra-rare assets. These range from the more traditional, like artworks or luxury watches, to the unprecedented, like investing in a restaurant franchise or a fleet of Teslas.

My detailed analysis of Caption

Diversified

Diversified was a French project co-founded by Vincent Bourdel and Tugdual de Kerviler, launched in April 2022. The site offered investments in non-traditional assets such as high-end watches, fine wines, and spirits starting at €100. They worked with French partners like Crésus for watches or Patriwine for wines.

The company was acquired by Konvi in 2024 after just over 2 years of activity.

Fractible

At the same time, another French project fell under the Irish banner. Fractible, co-founded by Fabrice Cicion and Romain Rubino, also started in early 2022. Less publicized than the previous two, it was nevertheless considered an interesting initiative for Konvi, which decided to make a double acquisition in France during the same period.

Expected Returns on Konvi

My performance

My journey on Konvi is still in its early stages, and I’m gradually building a well-diversified portfolio. I’m taking the time to explore the different investment opportunities, analyze the partners, and understand how the platform operates. So far, I’ve invested €3,050 across 11 alternative assets, primarily in the fields of art, collectibles, paleontology, jewelry, and watchmaking:

- €500 in a custom-designed Fabergé Egg (partner: Henry’s)

- €300 in a vintage Super Mario Bros game (partner: Henry’s)

- €250 in an Egyptian mummy funerary mask (Henry’s)

- €250 in a signed card featuring Michael Jordan, Magic Johnson, and Julius Erving (Legends Own the Game)

- €250 in a Beatles autograph (Paul Fraser)

- €250 in a dinosaur fossil trio (Fossil Realm)

- €250 in an Oriented Chondrite meteorite (Fossil Realm)

- €250 in a share of Banksy’s “Donuts (Chocolate)” artwork (TGB Contemporary)

- €250 in a Blue Cobalt Spinel gemstone (Ruby International)

- €250 in a fossilized sea lily (Fossil Realm)

- €250 in a fossilized fern with fish (Fossil Realm)

Just to clarify, these are fractional investments — I don’t fully own any of these collectibles, but rather hold a co-ownership share in each one.

I will update this article once the first sale of one of my purchases has been completed. In the meantime, I remain cautious. Konvi is still very young, and these assets, while diversified, are also very risky.

Past Performance

All operations are detailed regardless of their stage of progress. It is upon their update, once the underlying asset is sold, that the result of the operation can be seen.

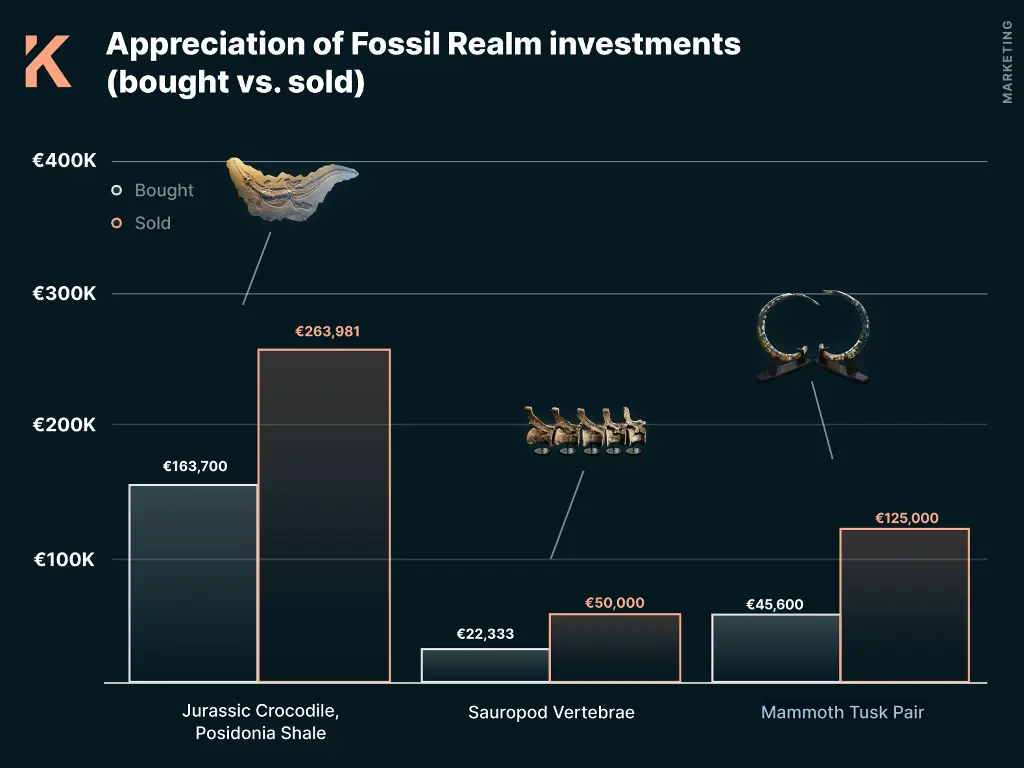

Here are the performances achieved by Konvi's partners before their partnership:

- Love Luxury resold a Hermès Birkin bag for £23,000 after buying it for £15,000 (+53%) less than a year earlier.

- Marat Gelman & Co. bought a work by Christian Awe entitled “Urban Life” for €40,000 and resold it for €60,000 (+50%) a year and a half later.

- Ruby International acquired a cobalt blue spinel (precious stone) for €75,000 and resold it for €85,000 (+13%) seven months later.

- Fossil Realm invested €35,000 in a Sauropod vertebra before selling it for €50,000 (+42.86%) a year later.

- TheCarCrowd purchased a Lancia Delta Integrale for £99,750 and sold it for €122,500 (+26%) eight months later.

Of course, past performance is no guarantee of future results.

Risks

After reading this analysis, you should be able to form your own opinion about the company. However, this should not replace your own research. Although I try to gather and synthesize as much information as possible, there are always additional things to discover.

You must also keep in mind all the potential risks associated with investing in alternative assets. And these apply both to Konvi and its partners.

Here are the measures the Irish platform has put in place to prevent potential problems:

- Neither Konvi nor its partner guarantees that you are the rightful owner of the item. A third-party legal entity is specially mandated for this mission. This should normally ensure fewer complications in case of bankruptcy of one of the two protagonists.

- At the end of the appreciation period defined at the time of purchase, if the partner has not found a new buyer, they have 6 months to find one. However, a buyer cannot be invented, and the item will have to lose value to hope to find one.

- There is currently no way to resell a share that you have purchased. Konvi is working on a secondary market to enable this, but no release date has been mentioned.

As always, invest only what you can afford to lose.

Fees and Taxes

Fees

Officially, the rate announced on the site is only 1% as a fee at the time of your investment. To understand what truly lies behind your investment, you need to dive into the Key Information Document (KID) for each offer. That's where you'll discover the numerous fees and costs applied by Konvi.

- Fixed margin: 18.5% of the invested amount to cover operational costs related to research and asset management with the partner, storage, identity verification (KYC), and anti-money laundering (AML).

- Resale fees: Between 0 and 2%.

- Annual fees: 0%.

- Performance: Commission of 5% to 14% on capital gains depending on the offer.

Taxes

On the tax side, nothing is indicated in the provided information. However, profits from crowdfunding and crowdsourcing operations are generally subject to a flat tax.

At the end of the year, Konvi provides you with the necessary tax documents for your declaration if you have made a profit.

The information in this paragraph does not constitute professional advice. It is recommended to consult a tax expert for any questions or important decisions related to your tax situation.