Satisfaction:

Potential Return:

Associated Risk: High.

Investment Horizon: 3 years.

Summary

Let me take you on a journey into an investment world as surprising as it is exotic. You'll get the chance to discover, or learn more about, the platform Konvi, which allowed me to acquire a share of this 52-million-year-old fossil. You’ll find all the details of this extraordinary acquisition, along with everything you need to know before embarking on a similar adventure. As always, I’ve tried to gather as much information as possible and be as precise, concrete, and data-driven as I can.

What I Like About This Investment:

- Access to an asset class that has long been reserved for experts or wealthy individuals.

- Delegating the search, conservation, and buying/selling to a specialized and reputable company in this market.

- Being able to invest from just €250.

- The symbolic value of the object: owning a small piece of something that existed millions of years ago.

What I Don’t Like:

- The platform is young and still needs to prove itself. I don’t like being among the first when it comes to investing.

- The fees applied are extremely high, but so are the potential returns on investment.

- An appreciation period of 3 years. This is on the higher end of what I usually practice.

Context

After exploring financial products, I wanted to invest in more concrete assets. Tangible items with prestige, history, and character. So, I became interested in wine and spirits, luxury watches on Caption, and vintage cars. Then, I discovered that it’s possible to go even further with increasingly rare objects. From precious stones to Birkin bags, and today’s focus: fossils.

How to Invest in a Fossil?

Normally, there are many ways to invest your money in an exotic asset, either directly or indirectly. Thanks to the financialization of much of what surrounds us, you can almost always find a thematic ETF or a listed company that is correlated to the type of asset you want to be exposed to. For example, to buy gold, you can obviously purchase it physically, but you can also hold a Physical Gold ETF or buy shares in a mining company like Newmont Mining.

When it comes to fossils, companies specifically linked to paleontology or archaeology and listed on the stock market are extremely rare. These fields are primarily academic disciplines or non-profit sectors, often funded by government institutions, universities, or private foundations.

Given this, fossils fall into an ultra-exotic and hard-to-access category of investments. So far, I know of only two ways to acquire them: physical purchase or the method I used for this operation.

I will write a complete guide on fossil investing to detail each method one by one, but today, we will focus on Konvi, the platform that allowed me to acquire this piece of rock dating back to the Eocene epoch.

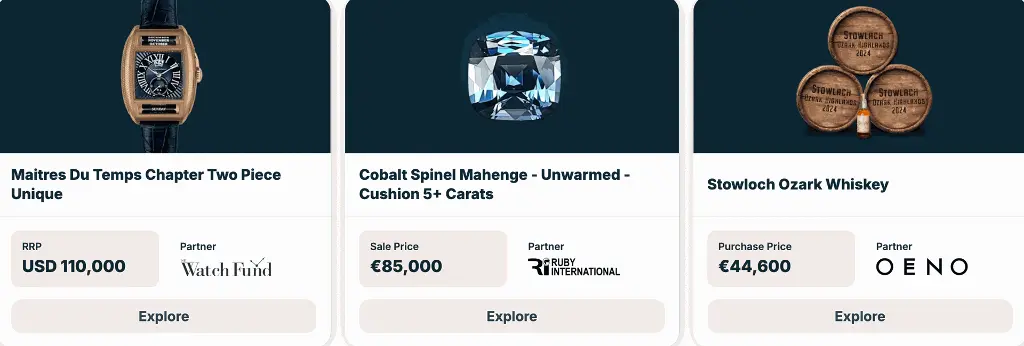

Presentation of Konvi

Konvi is an Irish platform dedicated to investments in tangible, rare, and prestigious assets such as luxury watches, fine wines, artworks, and many other highly attractive categories. It allows its users to access fractional shares of these exceptional items, thus opening the door to a world that was once reserved for a very exclusive circle of wealthy individuals.

With an easy-to-use interface and specialized partners for each type of asset, who handle the purchase, conservation, and resale of the items, Konvi offers a complete solution to enter these investment categories that were almost inaccessible not long ago.

I’ve written a comprehensive article about this platform, where you’ll find an in-depth analysis of Konvi, exploring its features, advantages, and the investment opportunities it offers. You’ll also find my personal experience, performance results, and everything I’ve learned to put you in the best position if you decide to get started.

Complete and Detailed Analysis of Konvi

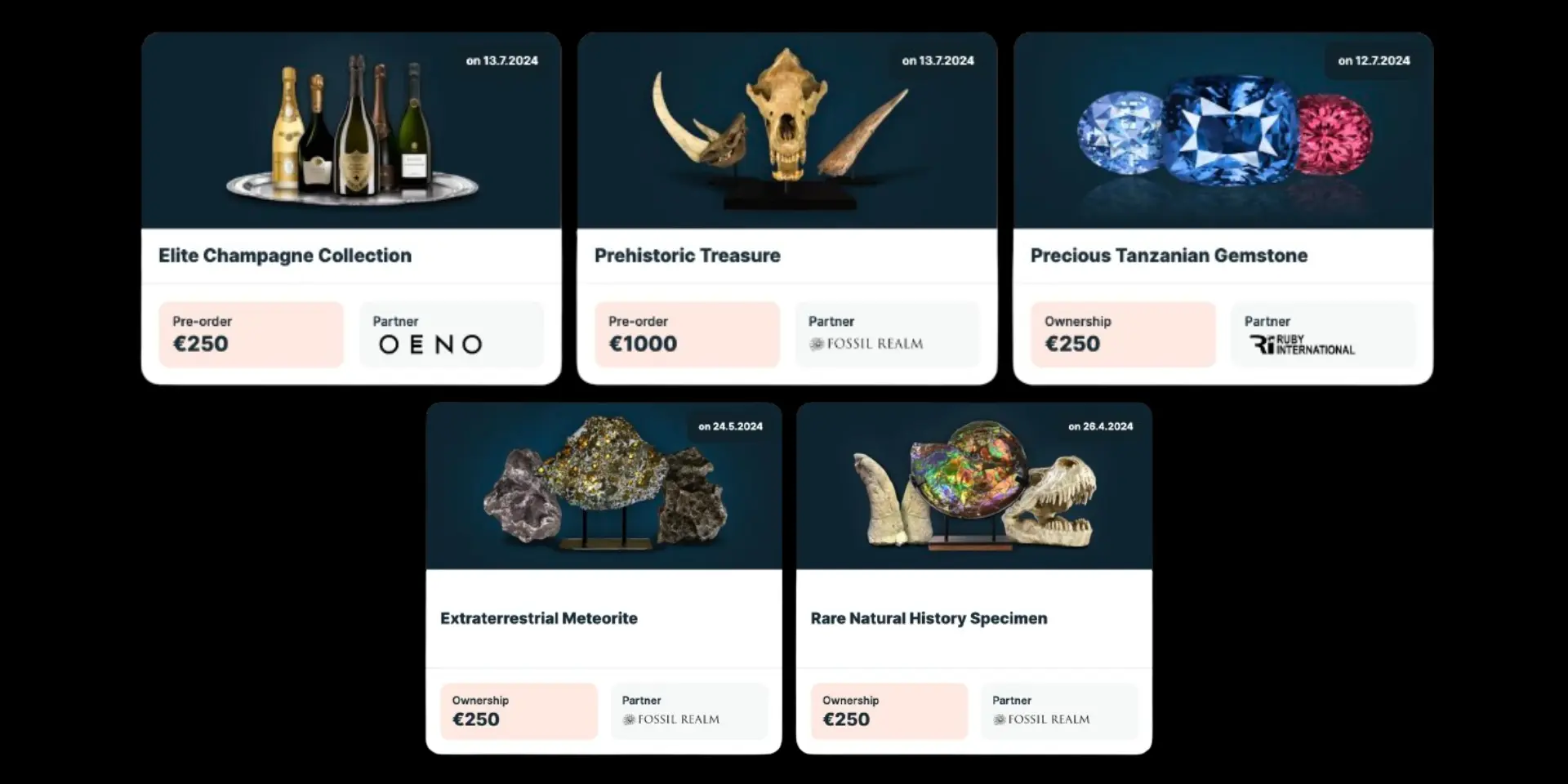

Presentation of the Fossil Realm Partner

Fossil Realm, founded in 2002 by Peter Lovisek, is an online gallery specializing in rare fossils, minerals, and meteorites. Some of its most notable sales include "Willard," the largest Triceratops skeleton ever discovered, and a Jurassic crocodile over 4 meters long. Today, Fossil Realm serves a prestigious clientele composed of museums, private collectors, and serious investors.

With over one million euros in annual sales, Fossil Realm guarantees the authenticity of each piece through certificates and strict ethical standards. As a member of the Association of Applied Paleontological Sciences, Peter Lovisek uses his platform to educate and promote fossils as tangible and sustainable investments. Through his collaboration with Konvi, he has helped to increase the recognition of natural specimens as attractive financial assets while offering pieces of exceptional scientific and aesthetic value.

Which Fossil Did I Invest In?

Operation Overview

To recap, on Konvi, the offers are presented similarly to the examples below. You receive information such as the type of asset, the partner involved in the operation, and the expected return on investment. By clicking on one, you gain access to more detailed information, such as the potential holding period before resale, the service providers involved, and more.

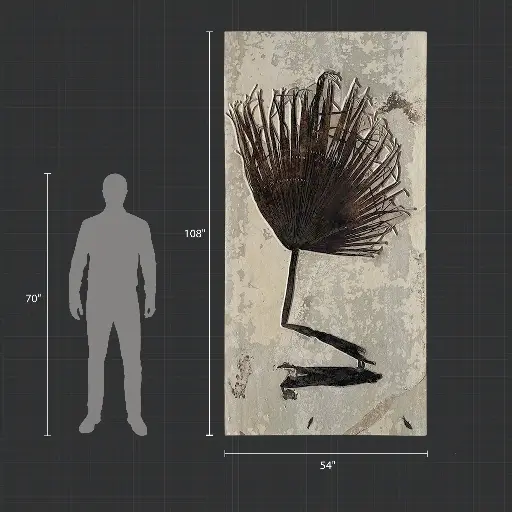

Regarding the offer I participated in, I knew I was going to become the owner of a “rare natural history specimen,” without knowing exactly which one. Once the fundraising target was reached, Fossil Realm's experts took care of finding an interesting opportunity within their network and on the market. A few weeks later, after the object was purchased by the partner, photos were sent to the Konvi investors, and I discovered that I was the proud owner of a “gigantic palm frond with fish, perfectly preserved,” which dates back over 52 million years.

Now, all that’s left is to wait. The appreciation period is set at 3 years. At the end of this period, if the asset hasn’t been sold, the partner is obligated to find a buyer within the following 6 months. Before the end of this 36-month period, the partner is open to purchase offers and will sell the asset if an offer 72% higher than the purchase price is made.

The Fossil in Detail

Say hello to a stone giant nearly 3 meters tall and 1.40 meters wide. Needless to say, I couldn’t have stored it in my living room—another advantage of fractional ownership.

This palm frond, dating back approximately 52 million years, was frozen in time alongside two small fish. This 450-kilogram leaf, complete and in excellent condition, is estimated to be worth around $120,000.

Additional Details for Enthusiasts:

- Origin: Lincoln County, Wyoming, USA

- Stratigraphic Layer: Lower Sandwich Bed (located below the 45.72 cm layer)

- Fish Species: Knightia eocaena

- Palm Species: Palmspices - Sabalites

Should you Invest in Fossils ?

My Performance

This section will be updated once the shares of this fossil are sold.

Are fossils a Good Investment?

On paper, Fossil Realm boasts impressive returns. The company manages €1.5 million in assets and observes an average growth of 35% on its fossil investments.

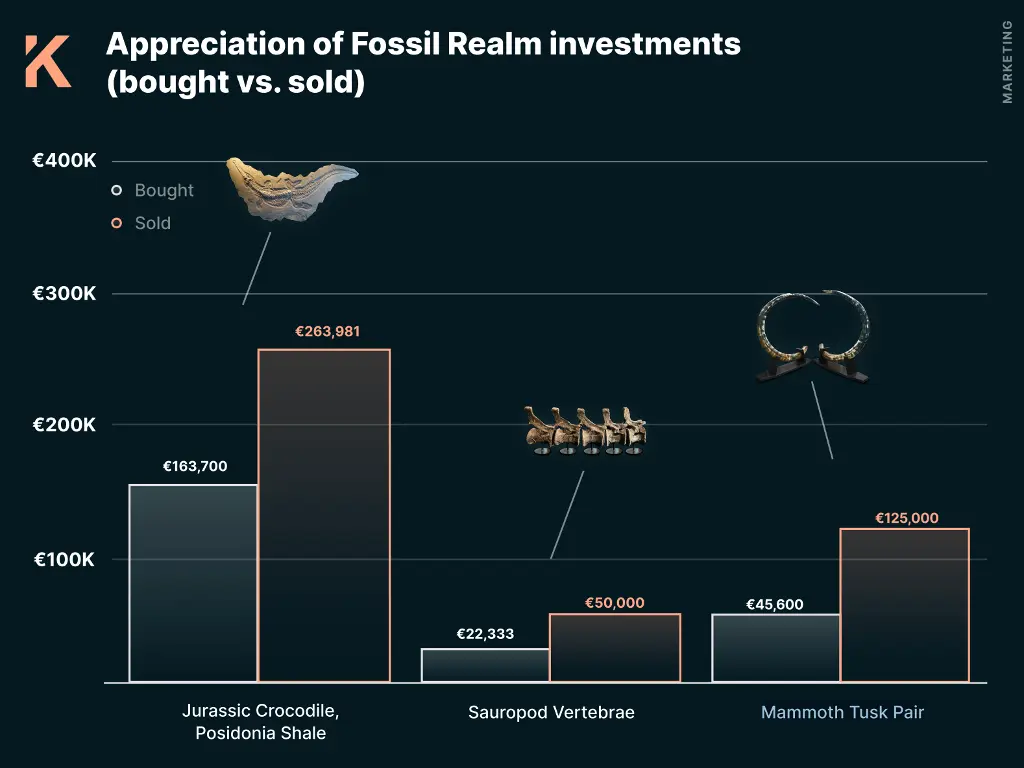

Among the highlighted operations by this partner, a Jurassic crocodile bought for €163,700 in 2019 was resold for €263,981 in 2022, achieving a gain of 61.26%. Another example is a pair of mammoth tusks, acquired for €45,600 in 2023 and sold for €125,000 the following year, generating a spectacular appreciation of 174.12%.

The strength of these specialized companies lies in their expertise in the market. Beyond the appreciation of these assets over time, it’s their knowledge that allows them to make good deals. For instance, Fossil Realm purchased sauropod vertebrae for €22,333 and resold them for €50,000 just a few months later.

What Are the Risks?

Investing in rare assets carries significant risks. The market for exotic goods is volatile, and their value can fluctuate greatly. With a young company like Konvi, the risk is even more pronounced. To mitigate these risks, Konvi has appointed a third-party legal entity, such as Classic Valuable Assets CLG, to certify your ownership of the assets. This is intended to protect your rights in case of any difficulties encountered by Konvi or its partners, providing an extra layer of security.

Additionally, the liquidity of these assets is not guaranteed. If no buyer is found at the end of the appreciation period, the sale may be delayed, sometimes requiring a price reduction. While Konvi is developing a secondary market, its effectiveness has yet to be proven.

It is crucial to invest only what you can afford to lose and to diversify your portfolio to increase your chances of success.

Fees and Taxation

Fees Applied by Konvi

For an investment of €250 in this Eocene fossil, here’s an estimate of the fixed and variable costs I’m exposed to:

Fixed Costs

- Fixed Margin of 10% included in the asset price:

- 10% of €250 = €25

- This margin covers payment transfer fees, legal agreements, identity verification (KYC), anti-money laundering (AML) procedures, and investor management.

Exchange Fees of 0.9% included in the asset price:

- 0.9% of €250 = €2.25

- These fees cover costs related to fund transfers to the asset provider.

Conservation fee of 6.13% included in the price:

- 6.13% of 250 € = 15.33 €

- These fees are related to storage during the appraisal period and until the sale.

Annual Management Fees of 1.5%:

- 1.5% of €250 per year = €3.75 x 3 years = €11.25

- These fees cover custody, management, audits, legal fees, and recurring taxes associated with the investment.

Variable Costs

Performance Fees in case of profit:

- If the asset achieves an annual appreciation of 20% or less: Commission of 6.15% on the profit realized.

- If the asset achieves an annual appreciation of more than 20%: Additional commission of 27.41% on the portion of profit exceeding 20% annual appreciation.

In summary, for my investment of €250, I need to take into account approximately €25 (fixed margin) + €2.25 (exchange fees) + €15.33 (storage fees) + €11.25 (management fees) in fixed costs, which amounts to a minimum of €53.83. This already represents 21.53% of the invested amount, before any potential variable fees that may be added based on the profit made.

Fossil Taxation

Work in progress.