Satisfaction:

Potential Return:

Associated Risk: High

Investment Horizon: 1 to 10 years

Summary

Pros of Masterworks

- Ultra-accessible entry point (just $20)

- A passionate and experienced founder (Scott Lynn)

- An exceptional and proprietary data platform

- Net positive returns on all artworks resold to date

Cons of Masterworks

- Very low liquidity for non-US investors (no access to the secondary market)

- Requires a phone interview in English to access the platform

- Long holding periods (1 to 10 years) with no guaranteed resale

Context

After investing in watches and wine, I turned to another classic tangible asset: contemporary art, or “Blue-Chip” art. It's a world that, until recently, never really captivated me—perhaps because I’ve always perceived it as a bit... “boring.” Strolling through exhibitions in museums or galleries never triggered much emotion in me, and I never quite understood the fascination some feel standing before a canvas. But I want to understand what drives people to spend hours in front of a single piece—or how a banana duct-taped to a white wall can fetch several million euros.

This is where investing brings purpose to learning. Getting curious, diving deep, and connecting with specialists naturally opens new doors and opportunities.

In 2023 alone, the art market was worth around $70 billion, while the value of collectible assets held by private individuals exceeded $2 trillion (Deloitte Art & Finance Report). It’s also a surprisingly liquid market, with 80% of artworks held by dealers being resold within two years.

From auction houses like Christie’s and Sotheby’s to top galleries like Gagosian, Perrotin, and Hauser & Wirth, and through to private collectors, the art world thrives on multiple players and resale channels. It was time to find a way to get in on the action—and maybe, like with watches, even start to enjoy it.

After researching platforms like Matis, Konvi, Splint Invest, and Artex, I chose to take my first steps in the art investment space with Masterworks.

What is Masterworks?

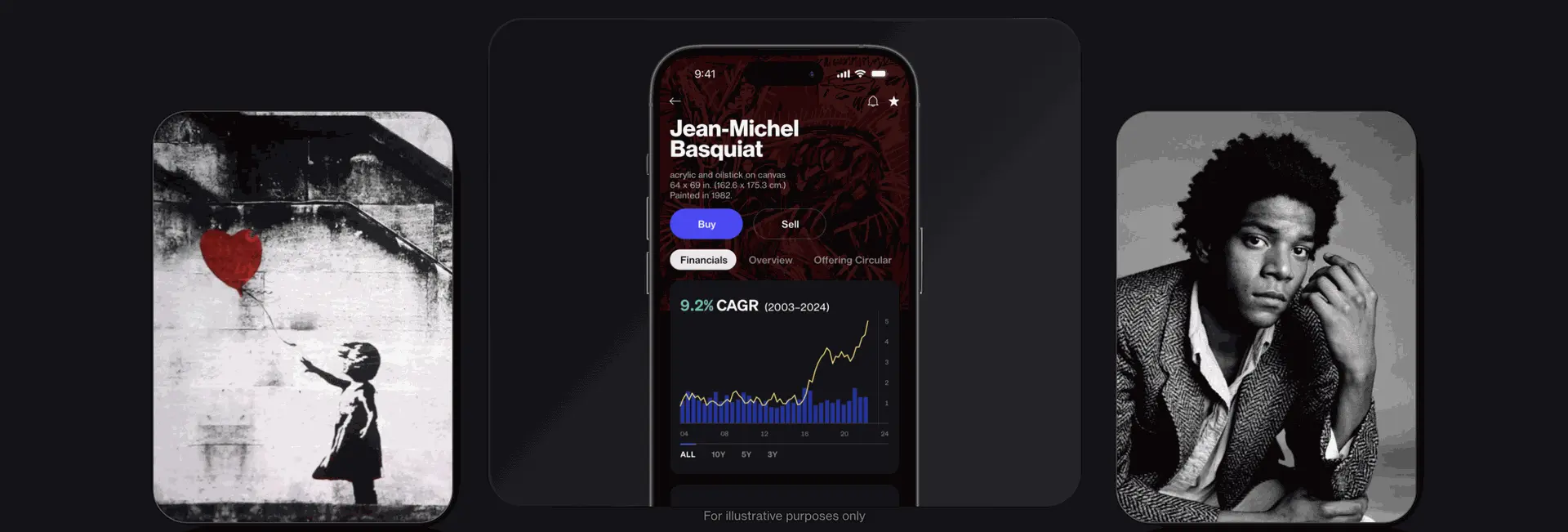

Masterworks is a US-based platform founded in 2017, specializing in fractional investment in fine art. Its mission is to make the art market financially accessible by allowing investors of all types to purchase shares in paintings by some of the most iconic artists in history.

As of today, nearly one million investors (985,127) have joined Masterworks to diversify their portfolios with these alternative assets. The platform boasts a catalogue of 450 artworks, including pieces by Basquiat, Banksy, Picasso, Warhol, and has already resold 23 paintings at a profit, redistributing over $61 million to its investors.

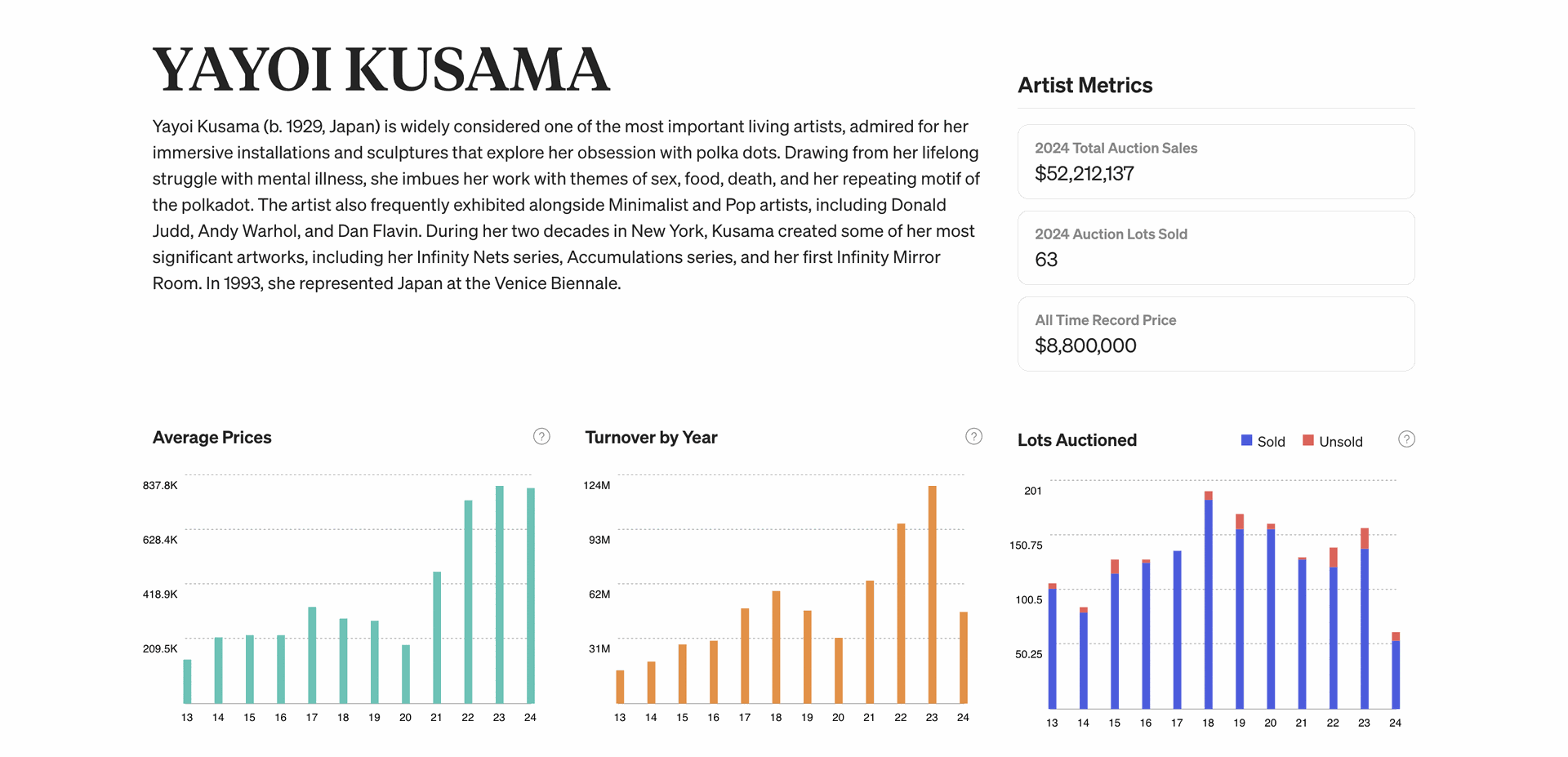

Each year, the platform analyzes 15,000 works of art to identify those with the highest appreciation potential. To do so, it has built the most comprehensive database in the art investment market, allowing it to spot trends and opportunities faster than anyone else.

Since joining, I’ve seen many prestigious names offered on the platform, such as Claude Monet, Yayoi Kusama, Cecily Brown, Pierre Soulages, and George Condo. These are predominantly “Blue-Chip” artists—well-established, internationally recognized names whose work is in high demand. This notoriety creates a more liquid market, making them ideal for investment.

Note: Beyond being a well-structured investment vehicle, Masterworks is also a powerful research tool for tracking the art market. Their data-driven approach makes it a valuable resource for any investor serious about art. Unlike other asset classes, the art world lacks robust performance indicators. The only public benchmark I’m aware of is theArtprice100© , but its updates are far too infrequent.

How Does Masterworks Work?

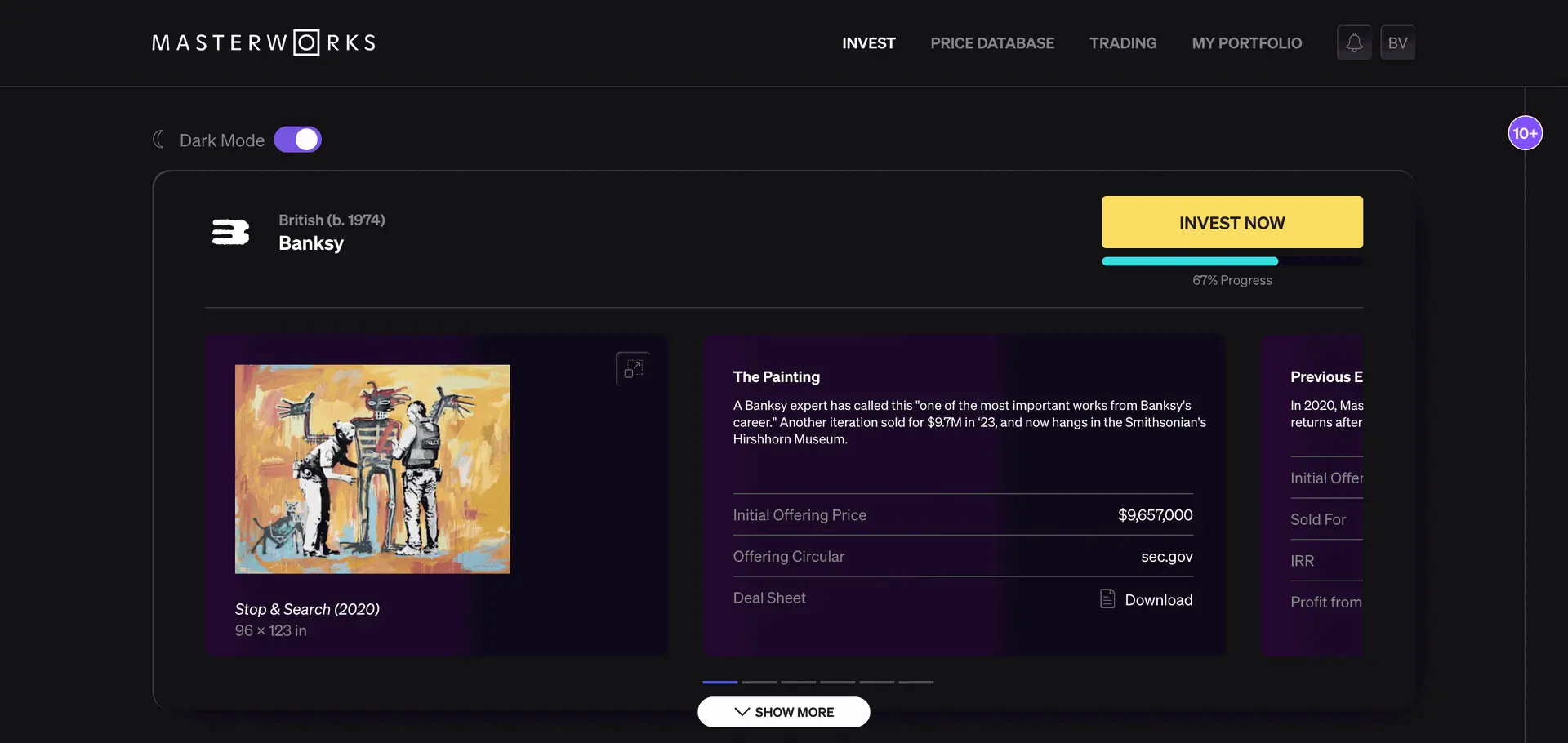

The platform specializes in acquiring and reselling Blue-Chip artworks—that is, highly sought-after pieces created by top 100 artists globally, based on rankings like the Artprice100©. Masterworks sources these works through major auction houses (like Sotheby’s and Christie’s), renowned galleries, or private collectors.

Each acquisition is carefully vetted through a proprietary analysis that draws from their in-house database of 24,000 art market segments (covering artists, periods, mediums, regions, and sales venues). Only the top 3% of artworks—those with the most promising appreciation potential based on historical data (past sales, artist records, market momentum)—make the cut.

On average, a new artwork is listed every 4 to 5 days. When a piece is eventually sold, Masterworks handles all associated transaction costs, the LLC tied to the artwork is liquidated, and net profits are distributed proportionally to investors based on the number of shares they hold.

Note: One of Masterworks’ defining characteristics is its high frequency of acquisitions. New offerings are released regularly, which is great from a user experience perspective, but it does raise questions about the selectivity of the platform. Personally, I prefer the more targeted strategy used by matis.club, which focuses on acquiring undervalued artworks from mispriced sellers, aiming to generate returns immediately upon purchase and sell more quickly. In contrast, Masterworks takes a long-term, value-oriented approach, betting on the gradual appreciation of top-tier artists.

The Structure Behind the Investment

Let’s take a quick behind-the-scenes look at how fractionalized art investment is made possible on Masterworks.

To enable investors to buy shares in artwork with such a low entry point, Masterworks uses a very specific legal structure. For each artwork listed on the platform, a separate legal entity is created in the form of a Limited Liability Company (LLC) based in the state of Delaware. This LLC then issues ordinary shares, which are registered with the SEC (U.S. Securities and Exchange Commission) under Regulation A—a framework that allows companies to raise capital from the public without going through the heavy regulatory burden of a traditional IPO.

Once the offering is approved, the LLC uses the capital raised to acquire a single artwork. Ownership of the painting is then transferred to a segregated portfolio company based in the Cayman Islands, a jurisdiction often used to provide legal protection and tax efficiency for international assets. The LLC holds no debt, no other assets, and exists solely for the purpose of holding, managing, and eventually selling the artwork.

Thanks to this setup, each artwork becomes its own independent company, and investors can purchase shares of that company, effectively owning fractions of the artwork—each priced at $20 per share. Masterworks manages the investment and covers all operational expenses in exchange for receiving a portion of the equity in the LLC. This structure offers a clear, regulated, and scalable model to bring fine art investment to the masses—without the need for millions in capital.

The Steps to Investing on Masterworks

As with any investment platform, signing up for Masterworks involves several legally required steps. Typically, this means filling out a questionnaire to assess your investor profile and financial literacy. However, what makes Masterworks unique is that I had to go through this process during a phone interview conducted in English. This call was mandatory to unlock access to the platform and guide me through my first investment. If this practice is still in place, it could be a barrier for non-English speakers—so I recommend doing it alongside someone comfortable with the language.

During the call, the advisor suggested a recommended investment amount based on my financial situation. That said, you're completely free to start with just $20, which is exactly what I did—choosing to take my time before committing more capital.

Once your account is verified, you gain access to explore available offerings, review detailed investment documentation, and choose your preferred artworks. From there, you simply make your payment or bank transfer and wait for the fundraising to close—after which you officially become a fractional owner of the piece.

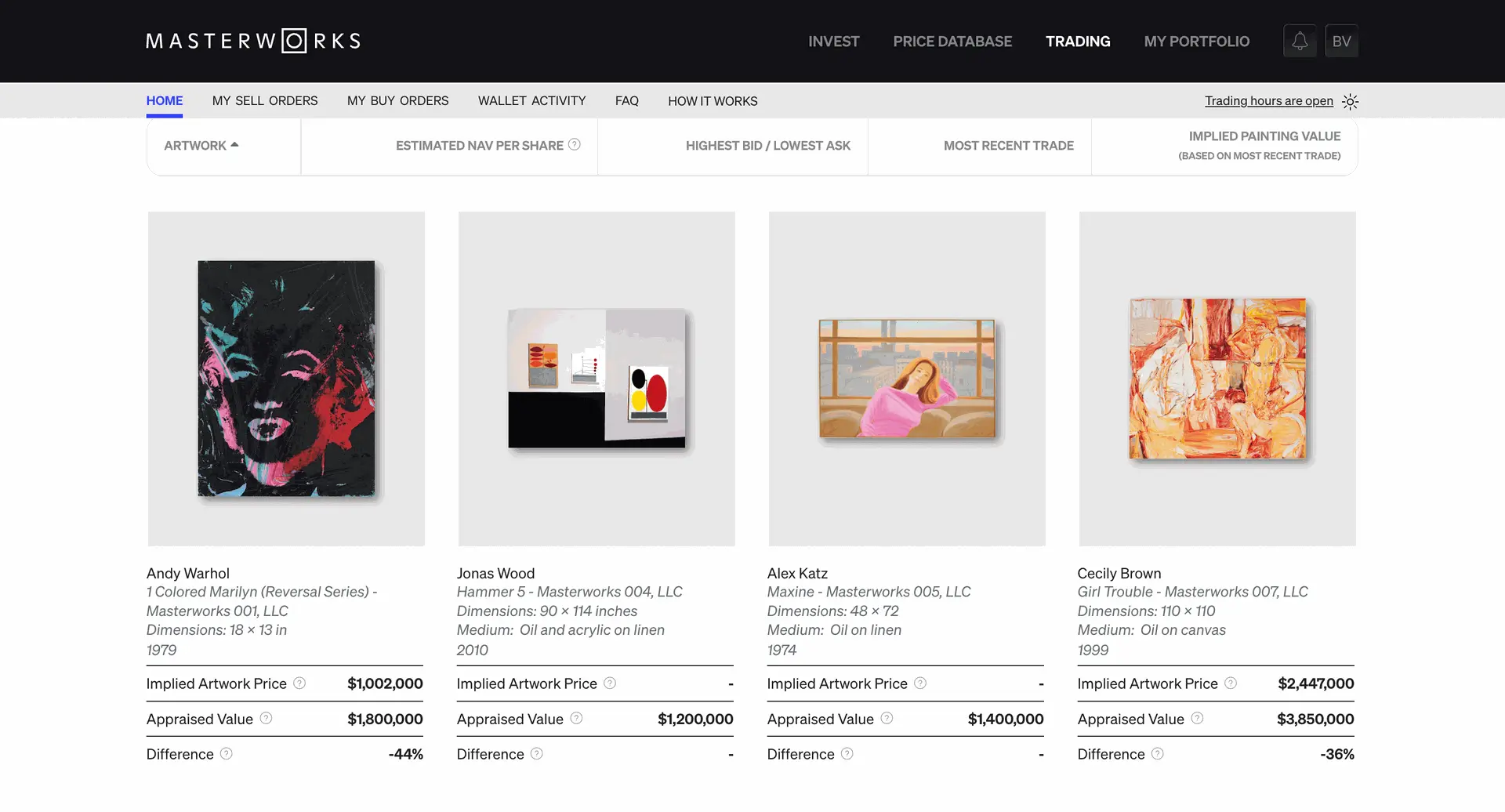

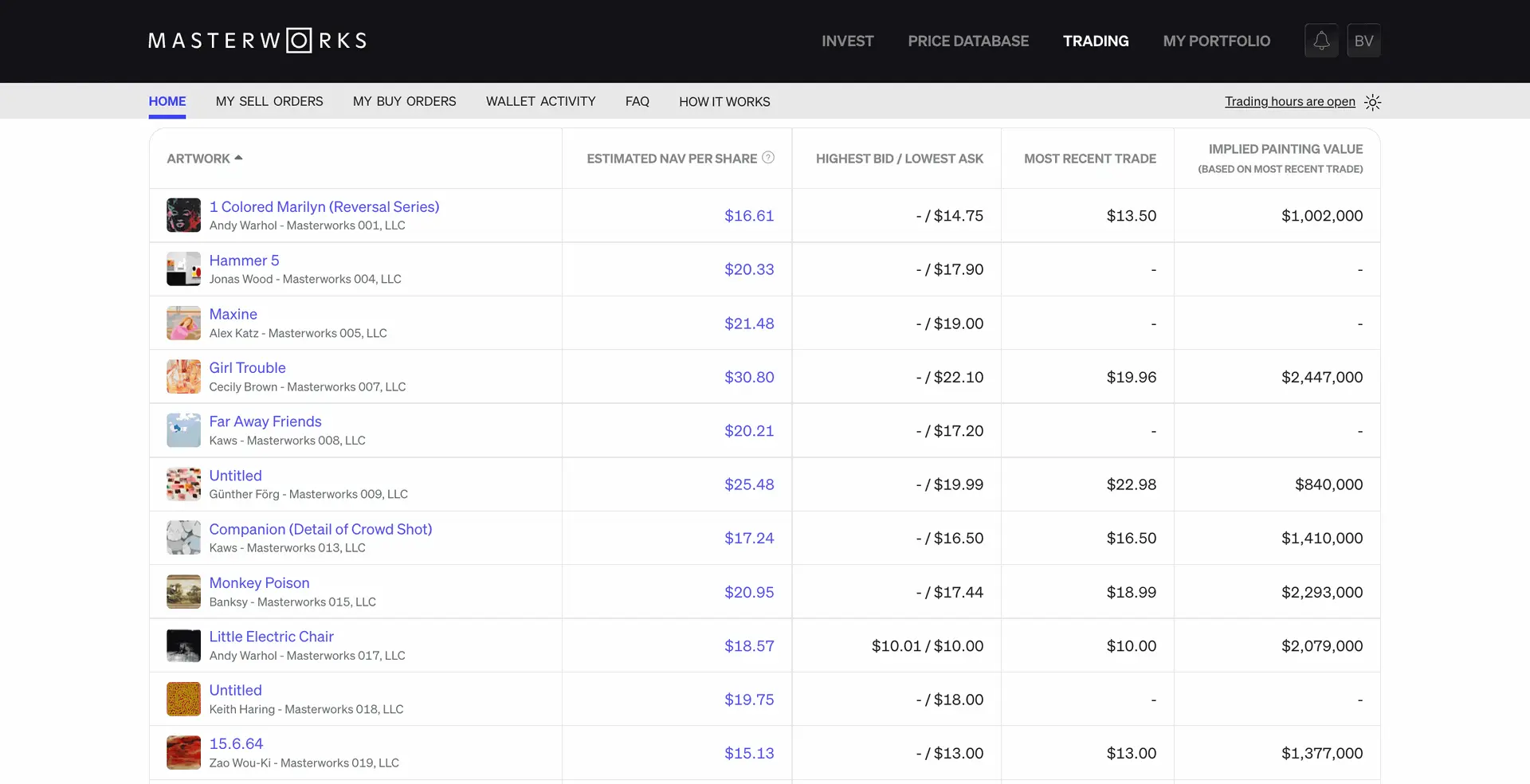

Masterworks Secondary Market

Trading shares on Masterworks happens through an alternative trading system (PPEX ATS) operated by North Capital, a registered broker-dealer. This secondary market works on a limit order basis, where buyers and sellers set their price and quantity.

To access it, you must:

- Wait 90 days after the final closing of your first investment,

- Open a brokerage account via North Capital,

- Complete KYC/AML verification,

- Fund your brokerage account to place orders.

However, this marketplace is restricted to U.S. investors only, and even for them, liquidity remains limited. There's no guarantee you’ll be able to sell your shares quickly—or at the price you want.

In my case, as a French tax resident, I can access the platform interface, but I’m not allowed to buy or sell shares on the secondary market.

Fundamental Analysis of Masterworks

Is Masterworks Legal?

Yes, Masterworks is fully legal and operates within a well-defined regulatory framework. The platform works in close collaboration with the U.S. Securities and Exchange Commission (SEC)—the American equivalent of France’s AMF, and effectively the country’s financial market watchdog. Each artwork offered for investment is accompanied by a public registration filing, available on the SEC’s website, containing all the relevant legal and financial disclosures.

While the mention of Cayman Islands structures may raise eyebrows for some, in Masterworks’ case, this is a standard legal tool used to protect ownership of artworks and optimize international tax treatment—without compromising the legality or transparency of the model.

Finally, the structure—via Delaware-based LLCs and Regulation A-registered share offerings—is clearly established and compliant with U.S. law. Investors are therefore fully protected under applicable regulations, as long as they review offering documents carefully and take the time to understand the product's structure before committing.

Founder's Profile – Scott Lynn

Scott Lynn is a visionary entrepreneur who started his digital journey early. At just 13 years old, he was already building websites for companies eager to embrace the internet.

At 19, he founded Virtumundo, which led him to launch Treeloot in 1998 with just a few thousand dollars. Within three months, Treeloot became a massive hit, achieving 500 million ad impressions per month and ranking among the most popular online games of the dot-com era. The ad revenue from Treeloot enabled Lynn to buy his first home and start collecting art, inspired by his mother’s love for drawing. Treeloot folded in 2001, and Virtumundo shut down in 2004.

Next, he launched Adknowledge, which grew into the fourth-largest ad marketplace after Google, Yahoo, and MSN—generating $300 million in revenue and employing 450 people.

In 2004, through his fund v2 ventures, Lynn founded, acquired, and exited multiple companies in digital advertising, marketing, and content.

Then, in 2014, he launched Payability, a fintech firm still active today, which has already advanced over $6 billion to e-commerce sellers.

He finally launched Masterworks in 2017, combining his passion for art and innovation, and also sits on the board of Brooklyn Rail, a nonprofit publication dedicated to the arts.

Despite his success, Lynn says that money has never been her primary motivation, but rather the pleasure of entrepreneurship and innovation.

Note: Scott Lynn embodies the dream of many entrepreneurs: to create a business that merges both passion and innovation. I have no doubt that he’s fully committed to nurturing Masterworks. Beyond that, he has a rare talent for turning bold ideas into long-term successes.

Is Masterworks Trustworthy?

Masterworks demonstrates several clear signs of credibility and reliability, starting with the transparency of its operations. Each artwork listed for investment undergoes annual audits by AGD Legal, a firm specializing in alternative asset oversight.

In addition, the platform publishes an audited financial statement every April 30, along with an unaudited interim report every September 30. For its diversified portfolios, audits are conducted by Citrin Cooperman, another respected name in financial oversight.

All artworks are stored in high-security, climate-controlled facilities, such as Delaware Freeport and UOVO—both designed to protect billions of dollars’ worth of fine art from fire, water, and environmental risks. Some pieces are also exhibited in galleries or loaned to museums, including Level & Co Gallery, which is open by appointment.

Valuations follow the Fair Market Value Appraisal method, a standard recognized by the IRS. Certified USPAP appraisers and art market professionals assess each piece based on artist, condition, creation date, and comparable sales. This approach gives investors a structured, data-backed entry into the fine art market—even with minimal capital.

From a reputational standpoint, Masterworks boasts an A+ rating from the Better Business Bureau (BBB)—the highest score issued by this independent American consumer protection body. To date, there have been no major scandals or lawsuits involving the company.

It’s worth noting, however, that while the individual offerings (LLCs and their securities) are registered with the SEC, the Masterworks parent company itself is not a registered investment advisor or fund manager. This doesn’t affect the legality of the platform but highlights the importance of understanding the structure and regulatory scope before investing.

Lastly, each artwork is insured through Lloyd’s of London, with up to $500 million in coverage per storage location. To minimize risk, Masterworks distributes its collection across multiple secure facilities.

With a team of around 250 employees, stringent storage procedures, audited financials, and a clear governance framework, Masterworks stands out as the most reliable player in the fractional art investment space today.

Alternatives to Masterworks

While Masterworks leads the space in fractional art investment, several emerging platforms offer alternative approaches—some with promising potential. Here's a look at the top alternatives, ranked by perceived credibility:

Matis

Matis is arguably the most credible European platform in this niche. Based in France, it uses a value-driven strategy, aiming to acquire underpriced artworks that can generate returns immediately upon purchase. The holding periods are shorter, and the platform offers strong transparency and hands-on investor support. A solid option for those seeking a more active, opportunistic approach to art investment.

Konvi

Konvi allows users to invest in a wide variety of collectible assets—watches, spirits, classic cars, and occasionally art. Its broad focus makes it accessible, especially with a low €250 minimum, but the fine art segment lacks depth for now. The platform is easy to use, but some fees remain unclear, and the team is relatively young, so caution is advised.

Splint Invest

Based in Switzerland, Splint Invest offers access to a wide range of tangible assets, including art. Its positioning is more institutional, and the platform carries a sense of professionalism. That said, art is still underrepresented, with more emphasis on other categories like wine, sneakers, and watches.

Timeless

Timeless is a German platform that appeals to a younger, pop culture–driven audience. In addition to art, it features items like sneakers, Pokémon cards, and luxury collectibles. While the user experience is playful and gamified, the quality and long-term investment logic of its assets are more questionable. This is a platform for fun, not fundamentals.

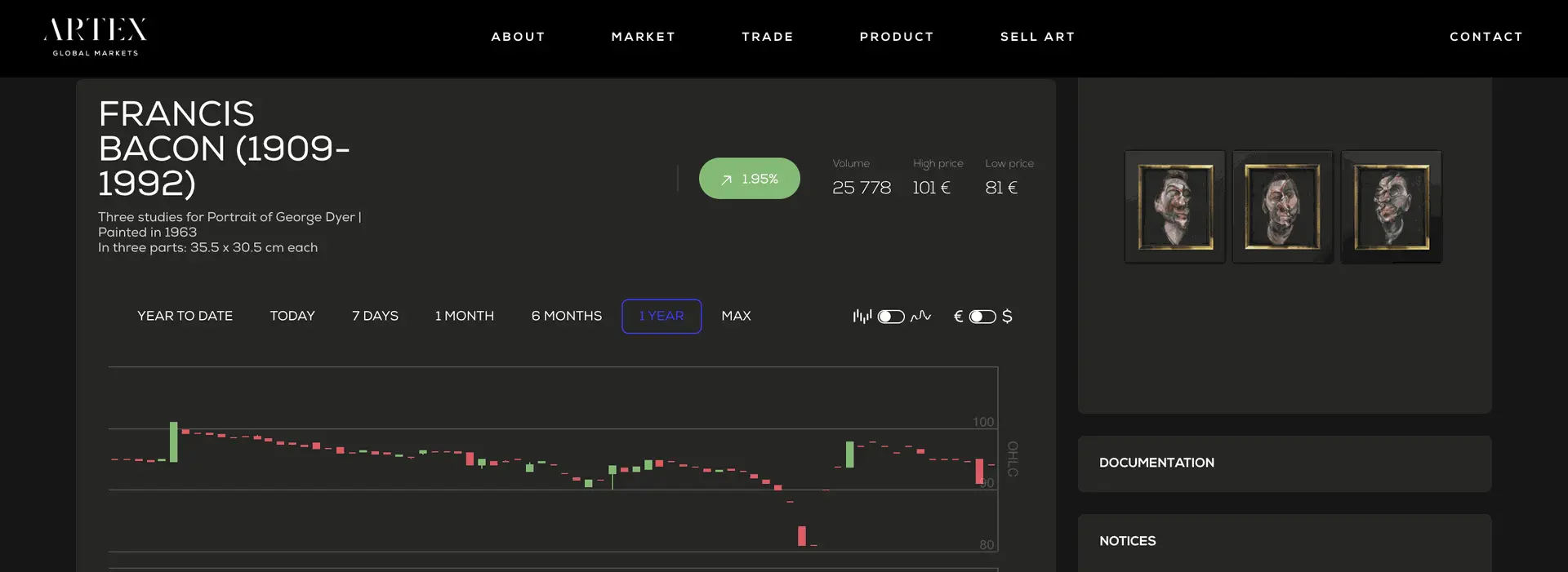

Artex

Artex aims to be the stock exchange of fine art, allowing shares in artworks to be traded in real time. The concept is bold, but still largely theoretical. Few works are available to retail investors, and the model lacks maturity, transparency, and liquidity. For now, it remains the least developed platform in the space.

What Returns Can You Expect from Masterworks?

My Portfolio

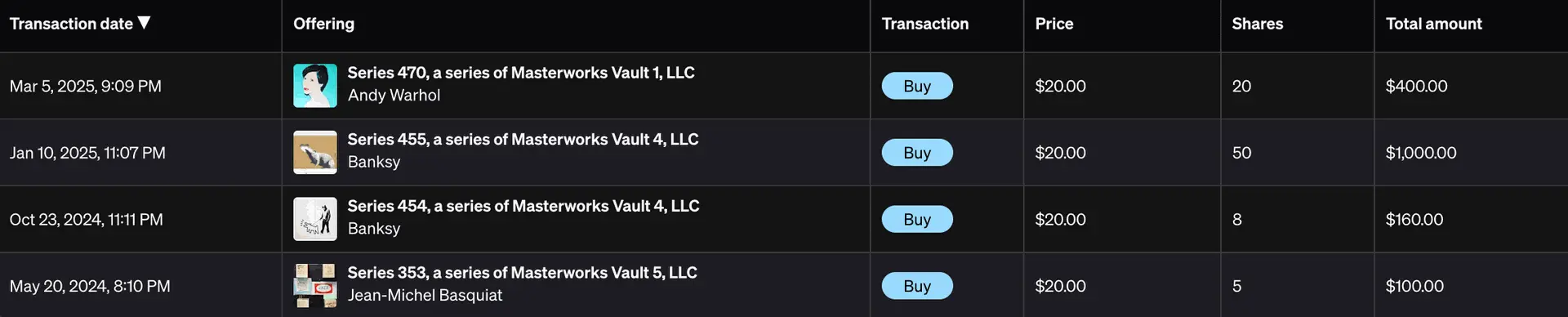

To date, I’ve invested $1,660 on Masterworks, spread across four iconic artists: Banksy (2 artworks), Andy Warhol, and Jean-Michel Basquiat. Each share was purchased at the standard $20 price point, the platform’s minimum.

Here's what I currently hold:

- 50 shares in Rat and Heart (Banksy)

- 20 shares in Unidentified Woman (Andy Warhol)

- 8 shares in Choose Your Weapon (Banksy)

- 5 shares in Jazz (Jean-Michel Basquiat)

My Performance

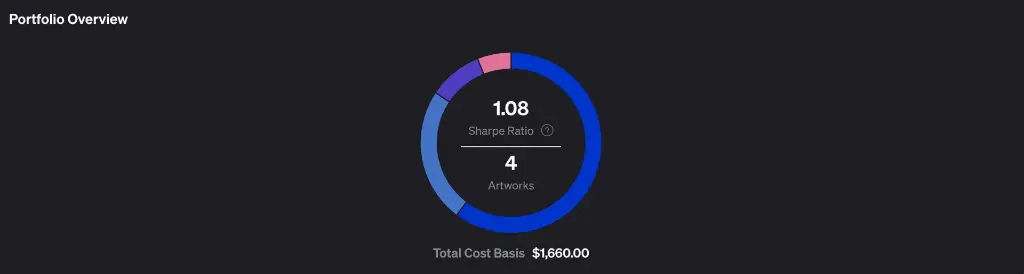

As of now, none of these artworks have been sold, so my net return remains 0%. However, my Sharpe Ratio currently stands at 1.08, which indicates a solid balance between risk and return potential across the selected works.

Note: My first investment on Masterworks was made on May 20, 2024. Since then, the value of my artworks has not yet been updated. I’m hoping this will be addressed soon, as I believe it’s reasonable to expect at least annual reappraisals—especially for a long-term investment.

Platform-Wide Returns

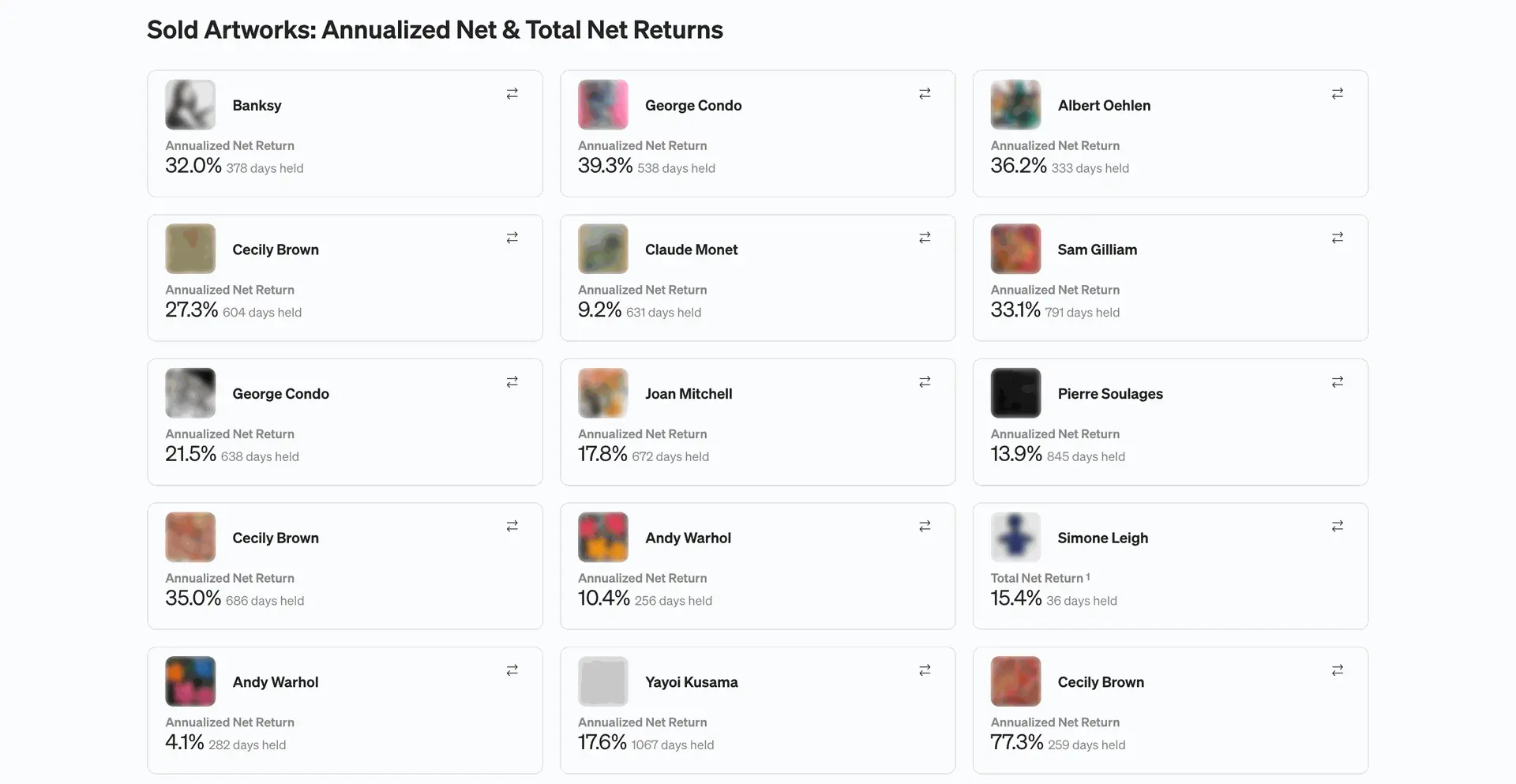

Masterworks has shared results from 23 profitable exits, and the data is impressive:

- George Condo: +39.3% annualized

- Albert Oehlen: +36.2% annualized

- Banksy: +32.0% annualized

- Cecily Brown: up to +35%, and even +77.3% over just 259 days

- Yayoi Kusama: +17.6%

- Sam Gilliam: +33.1%

Some returns are more modest but still positive:

- Andy Warhol: +4.1% annualized

- Jean-Michel Basquiat: +6.3% over three years

This performance data is evaluated using the Sharpe Ratio, which adjusts returns based on volatility and risk. Masterworks carefully analyzes each artist's market, ensuring investments are assessed not just on return potential but on price stability and market behavior.

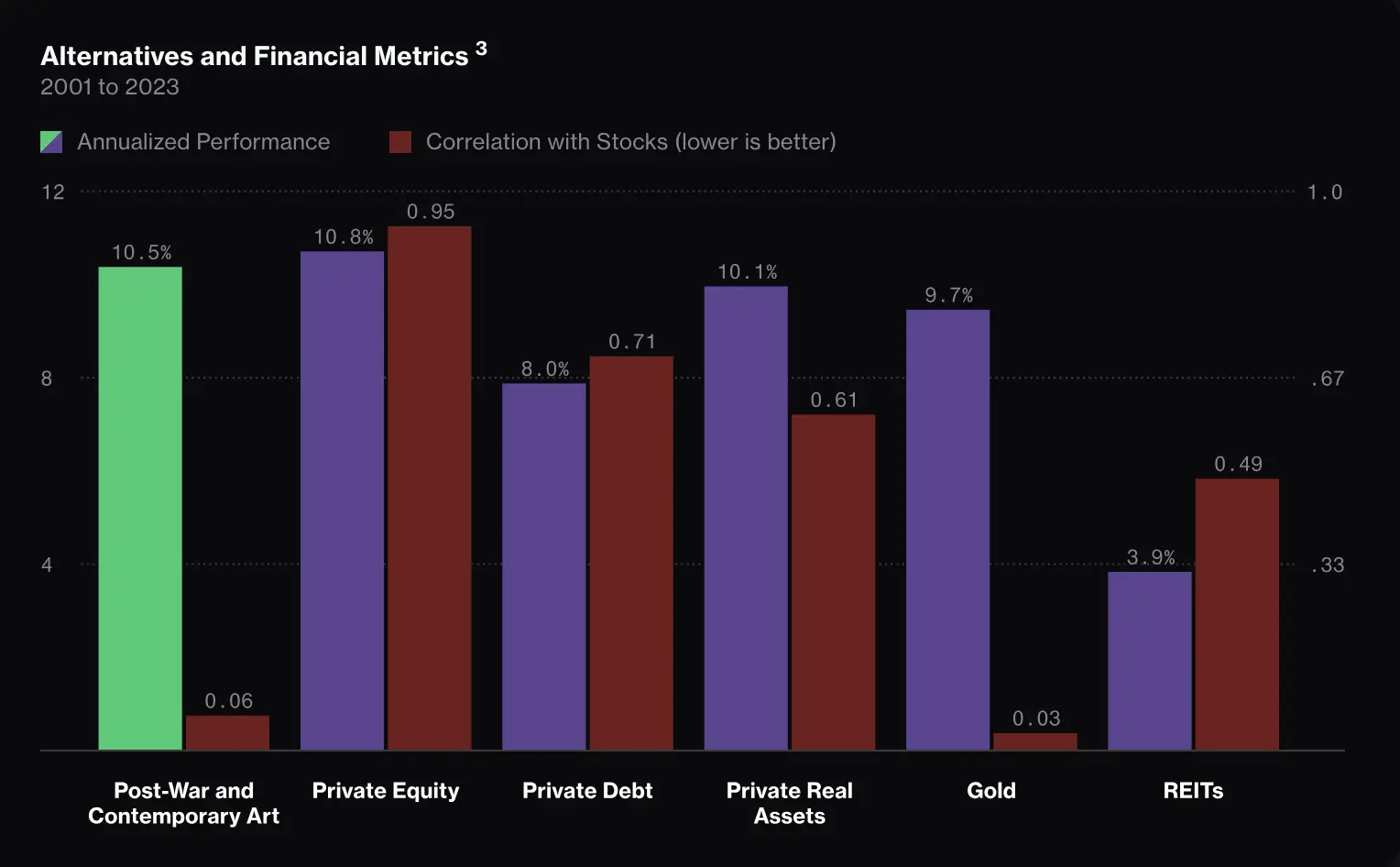

In broader terms, Blue-Chip art has outperformed the S&P 500 by 43% between 1995 and 2024, and contemporary art has outpaced nearly all other alternative assets from 2001 to 2023. It also maintains low correlation with public equities, making it a powerful diversification tool. As Goldman Sachs projects S&P 500 returns at just 3% annually, the case for art in an investment portfolio becomes increasingly relevant. Furthermore, a 2023 Deloitte study found that 52% of family offices view art as a hedge against inflation, reinforcing its appeal as a long-term store of value.

Naturally, past performance is no guarantee of future results. Art remains a speculative and nuanced asset class.

Risks

Risks of Investing in Art

Art, while a fascinating and potentially lucrative tangible asset, remains a high-risk investment class—especially in the context of fractional ownership. The most immediate risk lies in the volatility of the art market itself: the value of a piece can fluctuate dramatically based on shifting trends, news surrounding the artist, or broader economic conditions. There are no guarantees of returns or liquidity, and no automatic exit mechanisms in the event of a downturn.

Price trends for Picasso's works

Another important factor is the scarcity of reliable public data on the art secondary market. Unlike traditional financial markets, art transactions are often private, which makes valuations more opaque and sometimes subjective. This increases the risk of mispricing—either overpaying at acquisition or underselling upon exit.

Finally, even when investing through a reputable platform like Masterworks, you are ultimately entrusting an intermediary—one that selects, stores, manages, and resells the artwork. This introduces counterparty risk, which, while mitigated by Masterworks’ transparency and U.S. regulatory oversight, cannot be entirely eliminated.

Risks Associated with Masterworks

The primary risk with Masterworks lies in the nature of its business model: while promising, it remains relatively untested and not yet widely adopted. In the event the model fails, Masterworks states that it may be forced to auction off the artworks, which could significantly impact investor returns.

Additionally, it's important to remember that these investments are highly illiquid. Typically, artworks are held for 1 to 10 years, and there’s no guarantee you’ll be able to sell your shares once that period ends. The secondary market provided by Masterworks is limited in volume, offering no assurance of quick or profitable exits. Personally, I haven’t yet had the opportunity to test this feature.

Moreover, even though Masterworks manages your investment, the platform does not owe a fiduciary duty to its users. This means that the interests of Masterworks—or its Board of Managers—may not always align with those of the investor, which is common in indirect asset ownership models.

In short, Masterworks provides an innovative gateway into the art market, but it remains a long-term, illiquid investment. It's therefore recommended to limit exposure to a small portion of your portfolio (under 2%), as with any alternative asset class.

Fees and Taxation

Fees

Masterworks has developed a unique fee structure designed to avoid direct charges at the time of investment. In practice, no money is taken out of your pocket—the platform compensates itself in equity, meaning it owns a portion of the artwork alongside you. This aligns part of its interest with yours.

There are two main types of fees:

- 1.5% annual management fee, which covers security, insurance, storage, and administrative costs. Rather than invoicing you directly, Masterworks issues 1.5% additional shares to itself each year, causing slight dilution of your stake over time.

- 20% performance fee on net profits at the time of sale. If an artwork is sold at a gain, Masterworks keeps 20% of that profit, and the rest is distributed to investors based on the shares they hold.

For example, starting with 1,000 shares, after 10 years of 1.5% dilution per year, there would be about 1,160 shares total, with Masterworks holding approximately 13.8%. This represents the cumulative cost of management over a decade, without any direct payment from investors.

This model makes the platform highly accessible and smooth to use, but keep in mind that it reduces your share of potential profits. The net performance shown already accounts for these two fees.

Recurring Investment Plan Fees

For investors using the Recurring Investment Plan, monthly fixed fees apply based on the amount invested:

- Under $500: $1/month

- $501 to $2,500: $2/month

- Over $2,500: $4/month

These fees are accumulated monthly and charged at the end of the calendar year (or when the advisory relationship ends). They only apply to automated recurring investments, not manual investments.

Taxation

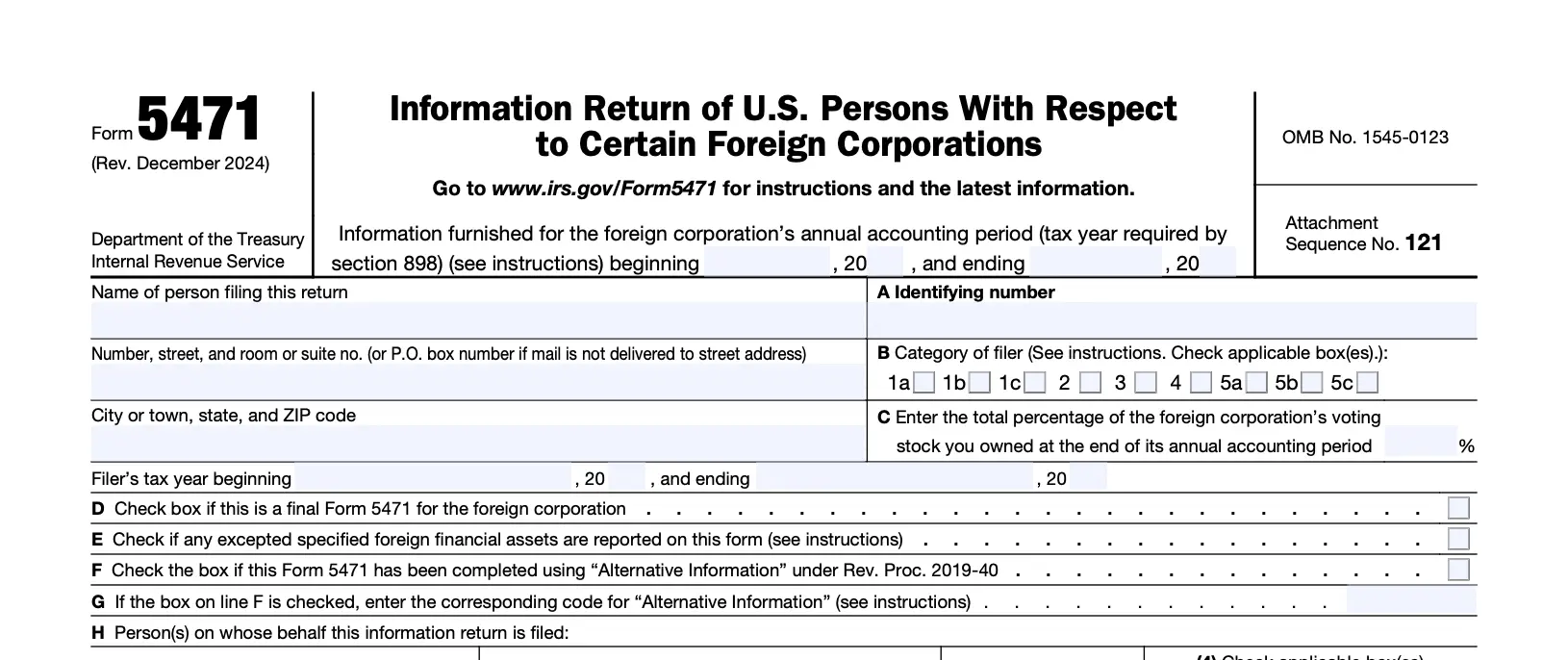

Investing in Masterworks as a non-U.S. resident does not generate any direct U.S. tax obligations, as long as you don’t have other U.S.-sourced income. In other words, you don’t need to file or pay U.S. taxes simply for holding shares in artworks via the platform.

Additionally, the legal structures used by Masterworks (LLCs, CFCs, and PFICs) comply with IRS requirements by filing their own tax forms (Forms 5471 and 8621). This means that, as a French investor, you do not need to submit these forms yourself, which greatly simplifies the process.

However, you remain subject to French taxation on capital gains realized upon the sale of your shares. These investments must be declared in your tax return, and potential tax liabilities should be calculated based on your personal financial situation.

In summary, Masterworks minimizes international tax exposure, but your local tax rules take precedence—so it's best to plan ahead and consult a professional to invest with peace of mind.