The alliance between Lendopolis and Lendosphere strengthens competition in the European market for crowdfunding renewable energy projects.

In just a few months, Lendosphere, a subsidiary of the 123 Investment Managers Group, has taken a strategic position by successively acquiring AkuoCoop in June 2024, then Lendopolis at the end of the year, previously held by KissKissBankBank, subsidiary of La Banque Postale. Cette acquisition place ce nouvel ensemble comme un acteur important face à un concurrent de taille comme Enerfip sur le secteur de l'investissement responsable.

Performance Fusion

With over 600 million euros already raised through more than 1,000 projects in renewable energy, the merger of the two platforms has created a base of 100,000 investors.

By integrating Lendopolis as a subsidiary, Lendosphere strengthens its portfolio without announcing any changes to the brand, the team, or the mission of Lendopolis. The continuation of the distribution agreement with La Banque Postale through its subsidiary Louvre Banque Privée will continue to attract new investors looking to invest responsibly in Lendopolis projects.

The objectives of Lendosphere

In addition to this union, Lendosphere continues its sectoral diversification and geographical expansion, with a recent opening to markets such as Greece, Portugal, and Spain. The platform is thus broadening its offerings by incorporating projects related to forested areas and carbon finance, thereby meeting the growing expectations of investors seeking ethical and responsible investments.

What changes for my investments?

As an investor on Lendopolis, with one project completed and another ongoing, this partnership seems interesting to me if it leads to a unique and ultra-optimized platform.

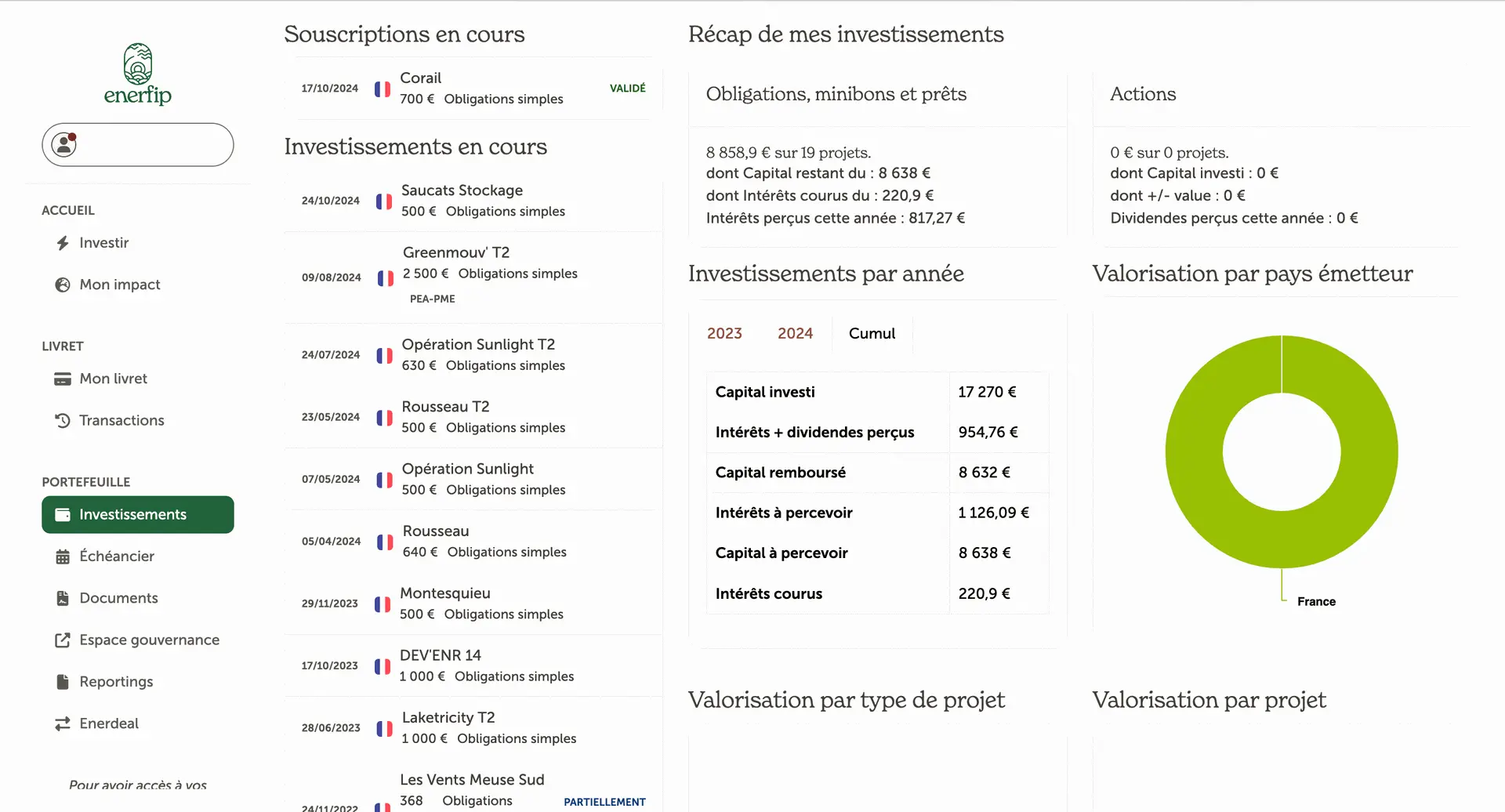

Actuellement, l'expérience sur Lendopolis est loin d'être aussi qualitative que ce que l'on peut retrouver sur Enerfip notamment. Les projets sont légèrement plus rémunérateurs sur cette dernière et l'interface proposée pour la gestion et le suivi de nos investissements est bien plus complète.

I wasn't planning to invest again in Lendopolis, but if it were to merge with Lendosphere to offer us a very innovative interface and high-performing projects, then I would definitely give it a try. For now, it seems that the two entities remain distinct, and this shouldn't impact my decisions.