Satisfaction:

Potential Return:

Associated Risk: Moderate.

Investment Horizon: 2 to 5 years.

Summary

Currently, when asked what my favorite investment is, I reply: "crowdfunding in renewable energy on Enerfip." I have tested dozens of investments, platforms, and types of alternative assets, and so far, this one satisfies me the most. Now, I will justify this choice in the most objective and detailed manner possible.

✅ Strengths:

- Enerfip is a French platform approved by the Autorité des Marchés Financiers (AMF) and regulated by the Autorité de Contrôle Prudentiel et de Résolution (ACPR).

- The projects are very well selected. The announced deadlines and payment schedules have always been respected for my 18 investments. More generally, there have been no problems, payment delays, or troubled projects on the platform for over 6 years.

- You can invest from as little as €10 without incurring any fees. Enerfip is compensated by taking between 2% and 10% of the funds raised by the project owner.

- The interface is extremely comprehensive and easy to use, offering complete autonomy in managing and monitoring our investments.

- The management team is experienced and complementary.

- The customer service is responsive and very efficient.

❌ Weaknesses:

- Few projects have durations shorter than 2 years.

- PEA-PME usable from €2,500. This is 5 times higher than my average investment, which unbalances my portfolio and impacts my risk management.

- If a project were to default, several years of accumulated profits would vanish.

Context

In 2022, while working in a mission-driven FoodTech company, a friend told me about Lendopolis. This is a French platform specializing in the crowdfunding of renewable energy projects. After conducting my own research, I identified another platform offering the same responsible investment scheme and that seemed just as serious: Enerfip.

At that time, there was still little literature on this category of ethical investment, but the signs were good. Moreover, the passive nature combined with my ecological values made it a responsible investment that suited my profile. Even though renewable energy investments are not as "sexy" as alternative investments like luxury watches or gold, I have maintained the philosophy of testing everything available before sorting out and keeping only what suits me best.

What is Enerfip?

Launched in 2014 by four co-founders, this Montpellier-based company allows individuals to participate in the financing of wind, photovoltaic, hydroelectric, bioenergy, energy storage, cooling or heating networks, and sustainable construction projects, primarily developed in Europe but also worldwide. Since the first crowdfunding in 2015, nearly 500 projects have attracted investors on the platform.

The company obtained its European accreditation in 2022 and is now expanding its activities in Spain, Italy, and the Benelux (Belgium, Netherlands, Luxembourg). This makes it the leader in responsible investment dedicated to financing the energy transition in Europe. The company is 100% owned by the founders and employees after buying back shares from minority shareholders.

How Does Enerfip Work?

Business model

Enerfip is a crowdfunding platform dedicated to renewable energy projects. It connects companies in the sector that need funds with individual or professional investors.

Cette mise en relation est essentielle, car souvent les banques demandent un apport aux porteurs de projets pour l'obtention du prêt qui permettra la réalisation de la construction. Plutôt que de puiser dans leur trésorerie, ces entreprises préfèrent financer cet apport via des plateformes de crowdfunding comme Enerfip ou Lendopolis, même si cela implique un taux d'intérêt élevé. Cet apport représente généralement les premiers millions d'un chantier qui peut se chiffrer à plusieurs dizaines de millions d'euros.

Here's how it works in practice :

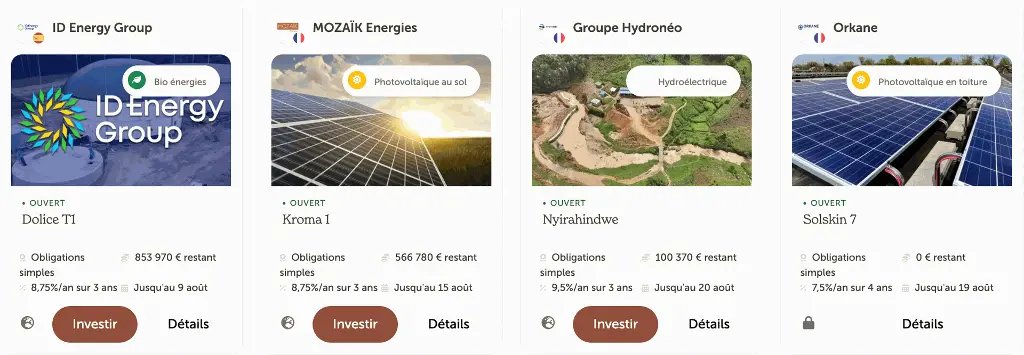

- Companies submit their proposals to Enerfip, which rigorously analyzes and selects projects. Only those that have reached an advanced maturity stage and demonstrate financial stability are offered to the community, representing about 20% of the financing requests submitted.

- All criteria, such as return, duration, and minimum fundraising target, are set and the offer is posted online.

- Investors are free to participate in the projects they choose starting from €10 (the price of a bond).

- If the minimum fundraising amount is reached, the operation is considered successful, and the project can commence. Otherwise, everyone is refunded without fees.

- On each agreed date in the schedule, the company reimburses investors with interest.

Enerfip offers a real gift to investors on its platform, as no fees are applied to their investment. Not before, not during, and not after. Only the companies seeking to raise funds are charged between 2% and 10% of the total amount collected.

Fundamental Analysis of Enerfip

As always, let's start with our due diligence to avoid unpleasant surprises.

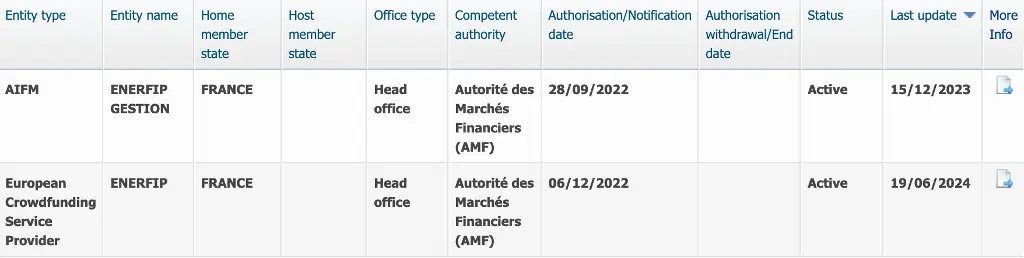

Is Enerfip legal?

For those new to crowdfunding, it is a financing practice permitted and regulated by the Monetary and Financial Code (articles L548-1 to L548-3).

Enerfip has all the necessary authorizations at the national and European levels. In France, it is approved by theAutorité des Marchés Financiers (AMF) and regulated by theAutorité de Contrôle Prudentiel et de Résolution (ACPR).

As the platform also offers securities subscription offers, also known as crowdequity, it is also regulated as a crowdfunding service provider (PSFP) by the European Securities and Markets Authority (ESMA).

Profiles of Enerfip's Executives and Founders

Founders

Julien Hostache, Co-founder, President, and COO of Enerfip

Julien graduated from the University of Nîmes in 2008 with a Master’s in Bio-Health. He then joined the Valeco group, a major local player in renewables, as a photovoltaic project manager, staying there for three productive years. After this initial experience, he left his southern homeland for two years to join Photowatt in the Lyon region as a systems business engineer. Before co-founding Enerfip, he honed his skills for three years at Envinergy as a photovoltaic director.

Today, he is involved in the relationship with project holders and in conducting technical, regulatory, and financial audits, in addition to presiding over the group.

My analysis: Even though it is his first entrepreneurial experience, Julien Hostache demonstrates both technical expertise, with over 150 rooftop installations and the completion of the first ground-mounted photovoltaic plant in France, and strong managerial skills.

Sébastien Jamme, Co-founder of Enerfip and President of Enerfip Gestion

Like Julien, Sébastien completed his studies in 2008 with a Master's in finance, strategy, and consulting from EDHEC, one of the best business schools in France.

He then accumulated nine years of experience as a financial manager at Velcan Energy, a company specializing in renewable energy, operating both in France and internationally. He acquired solid expertise in financing, financial analysis, and conducting audits for various projects.

Nine years after the launch of Enerfip, he took over as president of Enerfip Gestion, an affiliated management company specializing in private equity and infrastructure.

Léo Lemordant, Co-founder

After eight years of dedicated service, Léo left the company to become a Business Angel and start a new entrepreneurial chapter with the creation of Tellus AI.

Édouard Dischamp, Co-founder.

Édouard is the last of the four co-founders of the company. At the beginning of the year, he participated in the buyout of the minority shareholders' shares so that the founders and executives of Enerfip would be the sole owners of their project. Unfortunately, very little other information is available about him.

Executives

Vincent Clerc, General Manager of Enerfip Gestion

After obtaining two master's degrees in wealth management and private banking, followed by corporate financial management from Paris-Dauphine University, he started his career as a private wealth advisor in a Family Office. Following this two-year experience, he joined Enerfip in 2017. He remained dedicated to his role as director of distribution and partnerships for over six years before taking over the management of Enerfip Gestion, a management company distinct from Enerfip.

Guilhem Roux, General Manager of Enerfip

In 2018, Guilhem obtained a Master's in energy and finance from Paris-Dauphine University. Following this degree, he secured a position as a financial analyst at Enerfip and climbed the ranks one by one: first as a project manager for two years, then as project director for almost four years, and finally as general manager since the end of 2022.

My Perspective

Although they are all discovering the world of entrepreneurship, the company is led by complementary and experienced profiles. I am not surprised that their project has reached this stage after more than 10 years of existence.

Is Enerfip Reliable?

In 2017, the venture seemed to be on shaky ground. The company saw five of the platform's projects placed in bankruptcy proceedings, with another following in 2018. However, the team managed to learn from this challenging experience and successfully improved their selection process.

Today, they have an impeccable track record year after year, and the numbers speak for themselves:

- 450 projects financed, including 174 fully repaid.

- €523 million invested by 50,623 investors.

Detailed Performance of Enerfip

Since 2019, Crédit Agricole has even granted Enerfip an accreditation allowing all its French advisors to offer Enerfip products to their clients. This is a good way for them to position themselves on the theme of ethical investment and to enable their clients to invest responsibly.

Enerfip is even cited by the government as one of the reference players in the field of crowdfunding.

In 10 years, Enerfip has established itself as the undisputed leader in the renewable energy market in France, capturing more than 65% of the market share.

Alternatives to Enerfip

Lendopolis

In the landscape of crowdfunding for renewable energy, there is another very similar player, Lendopolis. I am also a client of this platform, which I discovered shortly before Enerfip.

Also launched in 2014, this French platform, approved by the Autorité des Marchés Financiers (AMF) as a Crowdfunding Service Provider (PSFP), is a subsidiary of La Banque Postale.

Update : Lendosphere acquires Lendopolis

Since its inception, it has financed 479 projects, of which 269 have been fully repaid. The average IRR obtained by investors in 2023 was 6.23%, compared to 6.96% on Enerfip.

Detailed Performance of Lendopolis

My opinion: I prefer to focus my attention on a single platform, but you can always consider it to take advantage of their welcome offer or for diversification purposes to reduce risks.

Comparison Table: Enerfip vs. Lendopolis:

Enerfip | Lendopolis | |

Type of Investment | Bonds, minibonds, loans, unlisted shares, donations. | Bonds, minibonds, loans, unlisted shares |

Internal Rate of Return (Net of Risk) 2023 | 6.96 % | 6.23 % |

Number of Projects Financed in 2023 | 63 | 33 |

Amount Financed in 2023 | €142,347,329 | €24,772,537 |

Average Weighted Loan Duration (months) in 2023 | 31.4 | 49 |

Average Annual Weighted Rate | 7.82 % | 6.16 % |

Number of Fully Repaid Projects | 168 | 265 |

Interest Paid | €11,249,183 | €10,856,809 |

Delays of 0 to 6 Months | 0 | 0 |

Delays Over 6 Months and/or Bankruptcy Proceedings | 6 | 37 |

Definitive Loss | 0 | 33 |

Status | ENERFIP is a SAS located in Montpellier. | Lendopolis is a subsidiary of La Banque Postale. |

AMF Approved Platform | Yes | Yes |

Member of the French Crowdfunding Association 2024 | Yes | Yes |

Interface and Personal Space | 9/10 | 7/10 |

What Returns to Expect on Enerfip?

My Operations

As of August 1, 2024, I have completed a total of 18 operations:

- 8 operations have been completed and repaid, 10 operations are ongoing.

- 100% of these operations were conducted with French companies.

- 17 out of 18 projects are in the form of simple bonds and one in the form of convertible bonds.

- 17 operations concern photovoltaic projects and one finances a wind project.

My Investment Criteria in Order of Importance:

- Location of Construction and Nationality of the Company: I prioritize projects that positively impact our territory and its energy sovereignty.

- Rating Between A+ and C: Ensuring a balance between risk and return.

- Senior Debt Rank: This means that if the company that raised the funds goes bankrupt, the remaining money will be used to repay Enerfip investors first.

- Lock-up Periods Less Than 3 Years: Focusing on short to medium-term investments.

My Performance

The 8 completed operations have generated a total of €711.43 in interest for €8,500 invested, representing a gross return of 8.37%. The average duration of these investments was 12.3 months, or 1 year.

Regarding the 10 ongoing operations, they should, if all goes as planned, yield €1,228.27 in interest for €8,270 invested, representing a return of 14.9% over an average lock-up period of 28 months.

I reinvest all generated interest into new operations to take advantage of compound interest.

Overall Platform Performance

Unsurprisingly, the interest rates distributed by the projects have progressively increased year after year. This is due to the general rise in rates across the entire economy.

Here is an overview of the average internal rate of return (net of risk) that you could have received in recent years by investing in the projects offered:

- 2021: 5,31%

- 2022: 4,33%

- 2023: 6,96%

- 2024: 7,83%

Let's also remember this impressive statistic: no bankruptcy or judicial proceedings, no losses, and no payment delays have been observed over the past six years.

Risks

This entire ecosystem of young companies that disrupts investment norms to make accessible what was once reserved for large portfolios or institutions is wonderful. However, additional intermediaries mean additional risks. Indeed, while danger can come from potential difficulties encountered by the project sponsor, it can also stem from these often economically fragile startups.

Thanks to the fundamental analysis conducted earlier in this article, you have been able to form your own opinion about Enerfip. Now, let's delve into how the projects offered for investment are selected.

Project Selection

- All funding requests are sent to a small team responsible for analyzing potential eligible requests based on legal criteria (business registration, statutes, shareholder agreements, accounting), technical criteria (technology maturity, equipment), and administrative criteria of the project (permits, certificates, attestations, contracts). This is the preliminary analysis.

- Projects that pass this first step receive a request for additional documents to deepen the initial analysis.

- When all documents have been analyzed, the analyst and project manager prepare a “questions/answers” document to address any unclear or misunderstood areas. This is then handed over to the project sponsor.

- If the project still meets the eligibility criteria, a summary analysis sheet is submitted to the Selection Committee for approval or rejection of the dossier and to define the project structuring and proposed terms (rate, duration, instruments, securities, etc.).

Ultimately, more than 80% of projects are rejected during these four stages. To ensure the satisfaction of its investor community and the sustainability of its business, Enerfip knows it cannot afford any mistakes. If a project were to cause hundreds of savers to lose their entire investment, years of hard-earned trust would go up in smoke.

Guarantees

For each proposed project, guarantees are requested from the project sponsors to cover the identified potential risks. These can include:

- Pledge of securities accounts linked to shares in companies.

- Mortgages

- Pledges

- Convertible bonds.

- Joint and several guarantees.

These guarantees could help Enerfip recover part of the money owed to you in the event of a payment default.

Project Rating

On the offer sheets, you will see a rating ranging from A+ to D- in the project characteristics. These ratings reflect the quality of the project sponsor and their project. This indicates the level of risk you are exposed to when lending your money.

Here are some guidelines to understand the different ratings:

- A+/A/A-: These are the safest projects. They are carried out by experienced companies with excellent technology.

- B+/B/B-: The companies behind these offers are slightly less high-quality but come with strong guarantees or securities.

- C+/C/C-: Third-tier ratings concern the same type of companies as the second, with mature or innovative technologies (C+ vs. C-) and satisfactory guarantees.

- D+/D/D-: These are developing or innovative projects proposed by companies with weak securities.

Liquidity

The common drawback of any crowdfunding operation is the inability to withdraw in case of need. Although it is recommended to invest only resources that you will not need shortly, we are never immune to a drastic change in situation during the few years of our investment.

This is where Enerfip demonstrates the quality of its platform. To make its market more liquid and allow you to part with your simple bonds, Enerfip has created a secondary market called Enerdeal, accessible to all investors who have verified their identity on the platform for over 6 months.

At the moment, only French offers financed more than 6 months ago and without payment delays are eligible for potential resale on this secondary market.

Fees and Taxation

Fees

It is always good to specify because this is not the case everywhere: registration on the site and access to offers are free on Enerfip.

However, what is truly astonishing and a huge advantage for investors is that there are no fees applied to your ethical investment. This truly rewards the efforts of those who wish to invest responsibly.

Enerfip's entire revenue comes from the project sponsors who wish to raise funds. Depending on the agreement with them, the platform charges them between 2% and 10% (including tax) of the total amount raised if the initial target is exceeded.

Taxation

Taxation differs depending on whether you are an individual or a legal entity, whether your tax residence is in France or not. It also differs depending on whether you invest in simple bonds, shares, loans, or minibonds. Finally, depending on the envelope you choose (e.g., PEA-PME), the taxation may vary, as well as if you benefit from certain schemes (e.g., Madelin reduction).

For an individual whose tax residence is in France, the flat tax (Prélèvement Forfaitaire Unique, PFU) will apply by default to all interest received.

For a company (legal entity), it is taxed under corporate tax in France according to the standard methods of profit tax (reduced rate of 15% up to €42,500 of profit for SMEs, 25% beyond that).

What Enerfip Says About Taxation

Every year, between March 1st and May 31st, Enerfip provides investors with a unique tax form (IFU).

These pieces of information are provided for informational purposes only and do not replace professional advice. For any questions or important decisions regarding your tax situation, it is advisable to consult an expert.