Satisfaction:

Potential Return:

Associated Risk: High.

Startups Investment Horizon: <5 years.

Summary

Caption is a French platform initially designed to allow anyone to invest in the promising start-ups of French Tech, and has gradually opened up new possibilities such as investing in luxury watches, gold coins, paintings, hectares of forest, and even unique assets like a restaurant franchise or music catalog rights.

✅ Pros :

- French platform registered with ORIAS and approved by the ACPR. It is accessible for free, very easy to use, and rich in information.

- Rare platform to invest in French unicorns.

- Rare French platform to invest in tangible assets (gold coins, artwork, etc.).

- Unique platform offering very rare assets like investing in a famous restaurant chain franchise or a fleet of Teslas.

❌ Cons :

- Minimum investment tickets that are becoming increasingly inaccessible (> €10,000).

- Premium subscription at €97/month lacking significant benefits for the price

Context

In 2022, the year I discovered Caption, I was working in a French scale-up (a start-up aiming to replicate its model on a larger scale) with about 300 employees. For over 2 years, I had been immersed in the world of fundraising, French Tech, and its unicorns. I was fascinated by this ecosystem that regularly saw new gems like Doctolib, Qonto, BlaBlaCar, Deezer, Swile, and many others emerge.

If my memory serves me right, I was attracted to Caption through an online advertisement that specifically promoted investing in these new stars of French Tech.

What is Caption ?

The Concept of the Platform ?

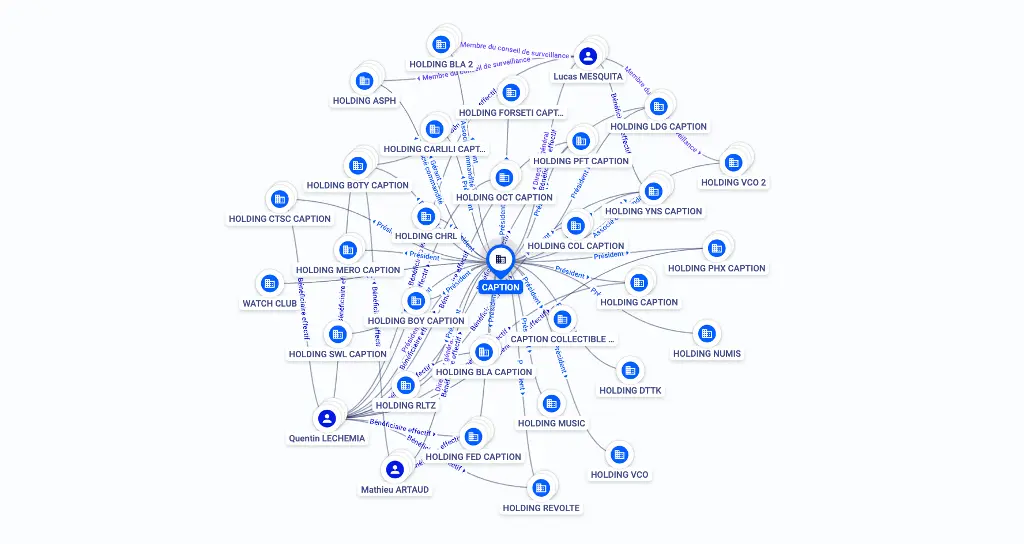

Founded at the end of 2020 by Quentin LECHEMIA, Mathieu ARTAUD, and Lucas MESQUITA, the platform aims to make Private Equity (non-public companies) investment accessible. Caption breaks down a significant barrier for small investors who could not access this category due to high minimum investment tickets, usually over €100,000.

Since then, the platform has grown significantly and now offers new investment opportunities, including alternative investments such as:

- Luxury watches

- Gold coins

- Paintings

- Restaurant chain franchises

- Music catalog rights

- Hectares of forest

- Car rental fleets, etc.

Caption has also launched its own investment fund (FPCI) called "Blueberry," specializing in early-stage French tech companies. This fund is reserved for larger portfolios, requiring a minimum allocation of €10,000 per year for the first three years.

Comment fonctionne Caption Market ?

To attract and retain their employees, startups regularly offer shares of their company to their executives. However, since these companies are not publicly traded, these employees cannot sell their shares even after leaving the company. Caption offers to buy their shares at a discount and then sells them on its platform.

If this operation is possible, it is because Caption creates a holding company for each proposed investment. Without going into operational details, this allows Caption to gather all investors under a single legal entity to carry out the operation. Thus, you become a shareholder of the holding company that holds the shares of the company you wish to invest in. The same mechanism applies to offers involving tangible assets. You receive bonds from the holding company that holds the pool of assets in which you are investing.

Le fonctionnement est presque similaire pour les offres dans des actifs tangibles. La holding acquière le bien et émet un total d'obligations équivalent à la valeur du bien de collection. Contrairement à Konvi, vous ne possédez pas votre objet et vous n'avez donc pas de droits de propriété direct sur celui-ci. Vos droits se portent sur les obligations de la holding qui détient le lot des actifs alternatifs dans lequel vous investissez. À noter que pour ces biens précieux, la Holding appartient à 75% à Caption et à 25% au partenaire spécialisé référencé par la plateforme.

Konvi: the alternative to Caption Market

Today, you can ultra-diversify your portfolio from a single platform and for much lower amounts than usually required. For the start-ups that interested me, I spent between €500 and €2000 per operation. I don't recall the minimum accepted amount, but they were even lower.

To offer deals related to collectible items, Caption references carefully selected specialized partners tasked with sourcing the products and their future buyers. This allows these partners to grow their business with more resources at their disposal and enables individuals to join the adventure by pocketing a share of the pie. Among the partners in this network, we find:

- Mecanicus for investing in vintage cars.

- Numismatic for investing in gold coins.

- Chrono24 for investment in luxury watches.

- CoeurForest for forest investment.

- Bolero for investment in music rights.

- Thoroughbred Invest for investment in racehorses.

- Urban COD for investment in rental cars.

Remarque : À noter que pour certaines des nouvelles catégories d’investissement proposées par Caption, les tickets minimums sont désormais de 10 000 €. Notamment pour l’acquisition de droits de catalogues musicaux et pour investir dans une franchise de la chaîne de restauration Pizza Hut.

Fundamental Analysis of Caption

As with any exotic investment, it is crucial to understand the fundamentals of the company offering the service. This helps avoid many unpleasant surprises. Investing your money is primarily a matter of trust.

Here are some examples of questions you must have answers to before investing:

- Is this investment method legal?

- Where is the company based?

- What is the experience of those behind the project?

- What guarantees does the company offer? (performance, quality of partners, etc.)

Is Caption Legal ?

On this point, everything is green.

The company is based in Paris (75002) and registered withORIAS. It is also enhanced by the Autorité de Contrôle Prudentiel et de Résolution (ACPR).

Public and private investment offers in financial securities of non-public companies or fund shares are offered as a tied agent of an Investment Service Provider (PSI). Only offers related to collectible items are proposed without this PSI agent status.

Profiles of Caption's founders

- Quentin Lechemia, The Serial Entrepreneur:

During his Master's in Accounting and Management, he took his first step into entrepreneurship by creating a website design agency in London. Although the venture lasted only a year, he quickly followed up with his first notable project: a marketplace connecting bookers and musicians called Div Up. A three-year adventure with significant results (8000 musicians registered, 6500 newsletter subscribers, and the creation of the EuroMusic Contest).

As soon as that ended, he started a new project in innovative outdoor advertising that attracted the biggest brands (Google, LVMH, Adidas, etc.) as clients. He sold ELISE Technologies 6 years later to the Sharing agency before embarking on the Caption adventure.

- Lucas Mesquita:

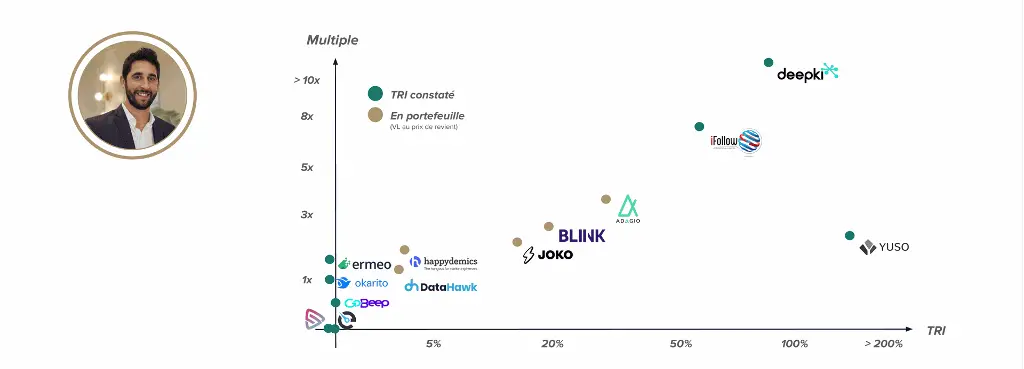

After a Master's in Evaluation and Financial Engineering, he had two brief stints (< 1 year) at Rhône-Alpes Création and BPI, respectively as an analyst and then as a business manager. Following that, he co-founded Axeleo Capital, where he spent nearly 7 years as an investment director. This experience allowed him to be close to the management of the companies he invested in, such as Okarito (acquired by Swile), Joko, and a certain company named ELISE Technologies.

Here are its investment performances:

- Mathieu Artaud:

Like Lucas, Mathieu gained experience during his two Master's degrees in business schools (audit-expertise and financial engineering) with four short experiences (< 1 year) as a financial auditor in prestigious firms like KPMG. He met Lucas at Axeleo Capital, where he worked for a year as a VC analyst before joining Vinci Energies as a Corporate Venture Manager for 2 years. This experience allowed him to serve on the boards of 5 start-ups in Vinci's portfolio.

Mathieu and Lucas made over twenty investments together in 7 years before co-founding Caption.

Is Caption reliable ?

Aujourd’hui, Caption est devenu une référence pour l’investissement en start-up et dans les investissements alternatifs. La plateforme compte plus de 48 000 investisseurs et a déjà collecté 45 000 000 €. Vous avez pu les voir dans des médias comme Forbes, Les Échos, Le Figaro, BFM Business ou encore Challenges.

Caption has gained the trust of employees from well-known French Tech companies to sell their shares, such as BlaBlaCar, Ledger, Swile, or Vestiaire Collective.

My perspective: So far, everything has gone well for me on the platform. I find that they do a serious job, and I have already been able to close some operations, which we will detail further in the article.

Alternatives to Caption

Today, there are many solutions for investing in start-ups. Caption mainly focuses on French start-ups, but there are platforms that have a broader scope.

Crowdcube

Crowdcube is the leading company for investment through crowdfunding. You will find start-ups established all over Europe since the platform is registered in England and Wales. There are companies at the very beginning of their journey and others already well-known to the public. I am very satisfied with their services. On Crowdcube, I have invested in:

- Heura Foods (Spain)

- Finary (France)

- Cornish Lithium (United Kingdom)

- Caldera Heat Batteries (United Kingdom)

- Artex (Liechtenstein)

I invested between 100 and 1000 € in each of these companies.

What I Like About Crowdcube :

- A reliable and very easy-to-use platform.

- Niche companies from all sectors (health, technology, finance, restaurant chains, etc.).

- New, well-documented offers every week.

Some figures:

- €204 million invested on the platform.

- 236 fundraisers completed.

- 307,000 European investors are registered on Crowdcube

Sowefund

Sowefund is recognized as a Prestataire de Services de Financement Participatif (PSFP) by the Autorité des Marchés Financiers (AMF). The offers primarily target French companies, often eligible forIR-PME.

My opinion on Sowefund: I wanted to invest in TechnoCarbon through Sowefund. Unfortunately, my interaction with customer service was very cumbersome, so I preferred to reconsider my decision and cancel this investment. I will give the platform time to mature before trying the experience again. Nevertheless, the offerings are well-documented, and there are some interesting companies to be found.

Others

There are other alternatives I have not yet used but are worth considering, such as Tudigo and Lita.co. You can also try joining a private club like Antony Bourbon's Blast Club (founder of Feed and business angel on "Who Wants to Be My Partner?").

Finally, there is also the possibility of investing in a Private Equity Fund. This allows you to delegate responsibility to professionals and diversify your investment. However, the minimum ticket will likely be much higher.

My performance on Caption

Start-ups

On Caption, I have made 5 operations, 4 of which are in the "start-up investment" segment.

I started with the acquisition of 158 BlaBlaCar shares in 2022. At that time, the company was about to benefit from a government trend to encourage carpooling, including two €100 bonuses for drivers. I repeated the same operation less than a year later when BlaBlaCar was planning its IPO. Today, the topic is no longer relevant, but the company has become profitable and is successfully internationalizing in Brazil and India.

Meanwhile, I also joined Swile by purchasing 2 shares at €832 each. It's a company whose product and communication I particularly appreciate. They quickly modernized the aging sector of employee benefits and meal vouchers.

I also wanted to invest in Doctrine, a Legaltech that facilitates the research work of lawyers, jurists, and other legal professionals, but the operation was canceled as the company was acquired at the same time.

My Operations in Detail:

Alternative Investments

The most recent investment via Caption was the acquisition of a share in a lot of 6 Rolex Daytona and 1 Rolex GMT-Master II, where I invested €2160. The offer was, in my opinion, unmissable as a buyback promise with a 15% net profit was already formulated if the lot was not resold within 9 months.

C’est ce qui s’est passé et j’ai reçu le virement de la Holding Watch Club de Caption quelques jours après.

Je détaille toute cette opération de la manière la plus transparente possible dans un article accessible avec le bouton ci-dessous.

As always, I must remind you that past performance does not predict future performance. Investing in watches is risky in many aspects that we will not have time to detail here.

Risks

Although the fundamental analysis is positive, investing in start-ups and through a young company like Caption remains risky. The same goes for all investments in the alternative assets highlighted on the platform.

It is also important to be aware that these investments are often immobilized for the long term. Few start-ups achieve consistent profitability over time. Do not invest money you might need in the coming years.

For non-public shares, there is no secondary market, and you will not be able to sell them. You will have to wait for the company you invested in to be acquired or go public.

For exotic assets, you will have to wait until Caption's partner finds a buyer willing to buy your asset at a higher price than at the time of your acquisition.

Fees and Taxation

Fees

The world of rare assets is often reserved for small clubs of investors or very private collector circles. To access it, you need to have significant funds to invest or pay to join. The advantage of Caption is that it is completely free. You can register, explore offers, and learn without spending a dime.

However, you can choose to subscribe to a premium membership at €95/month to get priority access when an offer goes online. This can be useful for highly demanded and quickly filled offers. Personally, I have not subscribed to this membership.

To invest in an offer, fees between 5% and 12% of the total investment will be applied at the time of subscription. Another interesting point is that you will not pay annual fees related to your investment (except for the Blueberry investment fund). This is rare, especially for tangible assets that usually involve many costs, including storage, associated insurance, or transportation.

My Opinion : For my part, I paid 6% fees for my investment in Swile and BlaBlaCar and 8% for the lot of Rolexes. I consider this acceptable when the goal is to achieve multiples or significant capital gains.

Tout sur les frais appliqué par Caption

Taxation

In most cases, there are no questions to ask; the Flat Tax is applied, i.e., 12.8% income tax and 17.2% social contributions.

Unfortunately, the PEA envelope is not available for these investments. The IR-PME tax reduction for investing in young innovative companies is also not possible because you are buying shares from other holders, not directly from the company.

For exotic assets, Caption tells us:

"Please note that all investments made in collectible items (luxury watches, artworks, etc.) through a dedicated holding (the issuer) are not subject to any tax benefit."

All about investment taxation Caption

Warning: The information provided in this section on taxation may contain inaccuracies. You are strongly advised to consult a qualified tax advisor for advice specific to your situation.